A Short History of Business and Entrepreneurial Evolution during the 20th Century

Trends for the new millennium

Abstract

This paper presents an historical narrative about the role business and entrepreneurship has played in global development. It starts off with some of the key legacies of the 19th century and describes events through the 20th century in chronological order up until the first decade of this millennium. The paper concludes by peering into the future through the extrapolation of events that have taken place.

1. Introduction

Looking at entrepreneurship from the economic-history context allows us to look at the flow of events in time and space such as inventions and innovations, the context in which they occurred and the impacts upon society these actions and events had. Looking directly at the biographies of historical figures can assist us in seeing the historical contexts of their efforts, innovations, or inventions. This may help us to understand how their insights occurred and opportunities were identified and exploited, showing us the reasons behind the trajectories these historical figures took with their inventions and innovations which impacted upon society’s future development path.1 Take for example the biography of Thomas Edison we can see the importance of systematic development work, self promotion, and having a workable and viable business model in mind to exploit any subsequent invention. These were paramount elements of his success. Many of the failing entrepreneurs of the dot.com bust of 2000 failed to see the necessity of having a workable and viable business model to exploit their ideas and could have well learnt from the lessons Edison gave us.

Many inventions, subsequent commercialization and acceptance by society have dramatically changed our way of life over the centuries. Electricity and the electric light, the aircraft and jet engine, the automobile and combustion engine, microchips, computers and mobile phones have all in different ways drastically changed society. These changes have led to further opportunities which entrepreneurs have been able to exploit. The transmission of electricity to homes allowed a host of other electrical devices to be invented, air travel led to air freight, travel agents, air terminal services, interstate, inter-regional and international business travel, and the building of hotels around the world, the automobile has led to automobile service stations, the invention of seat beats and other safety equipment, microchips have led to the invention of many items like digital watches, calculators, hand held GPS devices, and a host of other products. Computers and mobile phones have led to opportunities in software development and peripheral products and services. We owe the progression of our social existence to the invention of new technologies and ways of doing things, the creation of so many concepts and tangible things like alphabets, language, the wheel, farming techniques, cooking, social institutions, and the legal system, etc.

From the historical context it can be argued that innovation is governed by the period and place an entrepreneur resides.2 Thus innovation is a period and regional phenomenon3 and the great inventors through history were products of their environment spotting, and exploiting opportunities, rather than people with brilliance in isolation.4 The inventors and entrepreneurs only knew what their time and place allowed them to know.5 Innovation is thus a situational phenomenon and therefore the time and space aspect of understanding opportunity is important.

Following on from the above argument, novelty becomes a relative concept to time and space. Something that is new to one location may have long time been accepted product or service in another location. McDonalds was accepted in the United States market before it was introduced into foreign markets, were it was novel in each new market at the time of its introduction. Pizza was long accepted in Italy and Greece before it was introduced into the United States in the early 20th century and rest of the world after the Second World War. This has been an advantage for many students from developing countries studying in developed countries, where they have been able to identify novel business concepts in countries that they studied in, and went home to apply these concepts in their home countries upon their return. For example, many new manufacturing, retailing or service business concepts were started in South-East Asia by returning students. The Econsave supermarket group in Malaysia was inspired and foundered by Malaysian students observing independent Foodtown supermarkets in Melbourne, Australia.6

The nature of opportunity is such that it is ephemeral and transitory7 through time and space. Opportunity can be equated to periodically opening and closing doors along a corridor. True opportunities may not exist because a piece of technology is missing. For example, the idea of tourists visiting orbital hotels for holidays will remain only a concept until low cost transportation from the Earth to orbit has been developed. Thus space holidays may be an opportunity for another time, although it is an idea today. Many ideas have to wait for technology to catch up. An opportunity may exist in one place but not in another. Opportunities may exist for high end cafes and coffee shops in densely populated urban areas and high volume passenger transport terminals like railway stations and airports but there may be no opportunity for the same concept in much less populous rural areas where incomes may be much lower and the “urban café culture” does not exist. This shows the importance of time and space.

2. Legacies from the 18th and 19th Centuries

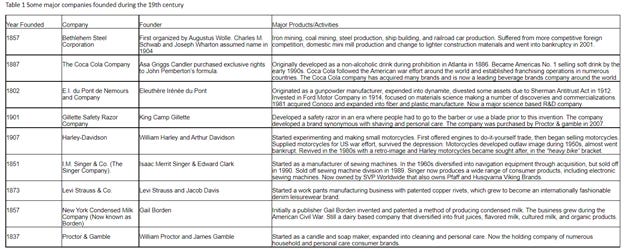

The inventors of the 18th and 19th Centuries made great contribution to the development of Britain, Europe, and America, laying the foundation for these regions to grow at unprecedented rates over the next century. The American South was developed through the steam boats and the cotton industry established with the aid of inventions by Kay, Hargreaves, Arkwright, and Crompton. The American West was settled through the assistance of the railroads and innovation with refrigeration which allowed the cattle industries to supply the East with meat. Some of the most well known American brand names were created during this time from entrepreneurial start-ups aimed at exploiting an opportunity, with similar stories to those outlined in the last section (see Table 1). Mercantilism declined in at the end of the 18th Century and the whale industry around the middle of the 19th Century when petroleum became a substitute for whale oil, showing that opportunity is characterized with a limited lifespan.

Table 1 Some major companies founded during the 19th century

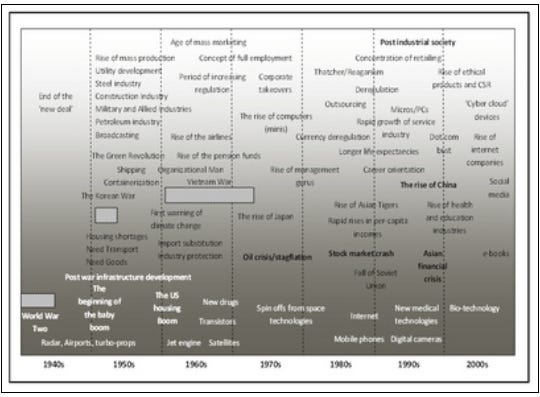

By the end of the 19th century and beginning of the 20th century governments had begun creating regulations and laws governing the railways, roads, banking, and business, establishing a stable business environment. Governments also began to realize their own fiscal and monetary abilities and began to manage their economies from a macro viewpoint. However the continued use of tariffs and protection was to hinder trade in the early 20th Century partly contributing to war and depression. Many entrepreneurs of the 19th Century set the tone of how invention and innovation would occur later in the 20th Century as individuals and corporations, i.e., industrial laboratories, skunk works, etc. Many of the industries started at the turn of the 20th Century were going to grow within massive industries as the century progressed, i.e., automobiles, aviation, steel, petroleum, electric power, communications, media entertainment, and processed products, etc. Entrepreneurship and innovation along the lines of the Schumpeter concept of creative destruction is what made society progress and this was best achieved when encouraged. Figure 1 shows a timeline for the second half of the 20th Century.

Figure 1 Timeline for the second half of the 20th century

The first part of the 20th Century was chaotic for growth and development due to protectionism and national self interest. There were two world wars within a space of less than thirty years. Britain was still a colonial power; Japan was rapidly becoming the power of the East, South-East Asia still underdeveloped and entrepreneurship in America stifled by Roosevelt’s quasi-socialist new deal programs.8 Although the Second World War had a positive influence on new technology development, it was only in the post war years that entrepreneurs began to reemerge in perhaps the fastest thirty years of growth the world had ever experienced. A barrage of new industries based upon newly developed technologies was created and grew, rapidly changing society.

The United States played a major role in victories in both the European and Pacific theatres of war. Most countries within Europe were devastated along with Germany and Japan. China was still locked in civil war and was then to undergo more than 30 years of isolation under Mao’s communist rule. The United States was intact and still had occupation troops in both Germany and Japan. The United States under the Marshall Plan took some responsibility for the restoration of Europe and focused on preventing loss of what had been gained in the battlefield to the communist movement. The US war effort had mobilized the steel/shipbuilding, aviation, automobile, and created a host of new technologies with post war civilian applications, where no other country was in this favored position.

After the Second World War, peace and the likelihood of better times ahead, birthrates dramatically increased across the United States, Europe, and Australia. This lead to a boom in housing with millions of new homes built in the United States alone within the first decade after the war. Automobile sales soared giving Americans the mobility they had never had before. Great demographic changes were occurring in the United States where people in the north were migrating to the south and west. Cities like Phoenix, Los Angeles, Tampa, Orlando, Dallas, and Houston grew dramatically. Women who worked in the factories during the war to support the war effort now had their own incomes and drastically increased purchases of clothes, ladies fashion items, cosmetics, and other consumer items leading to a great growth in consumption that led to many new opportunities in the personal consumption and household products sectors. This drove an emerging banking and financial sector which grew on mortgage and business borrowings.

These changed conditions gave way to many creative opportunities for those who could see them. For example, after the Second World War there were plenty of experienced women that had idle time after their children had grown up. Many mothers wanted part time work and many businesses wanted temporary skilled workers. Russell Kelly saw this connection in 1946 and started finding temporary jobs for part-time workers on a temporary basis. In his first year of business Kelly had 3 employees, 12 customers, and USD $848 in sales (Eaton 1998). Today Kelly Services has more than USD 5.3 Billion sales9 and operates across 30 countries. It can be claimed that Russell Kelly created the temporary employee industry that is worth more than USD 40 Billion worldwide covering engineering, education, nursing, and other industries with many 1000s of large and small businesses following the Kelly business model.

The example of Amway also shows how innovation can also come from a new business model that is constructed to take advantage of the increasing affluence and spending power of a growing American middle class and recognition that personal relationships have a great influence upon consumer buying decisions. Jay Van Andel and Richard DeVos were close friends and participated in a number of ventures together as partners in the 1940s that included a hamburger stall, air charter service, and sailing business. In 1949 they were introduced to Nutrilite Products, a direct selling company founded by Dr. Carl Rhenborg. Nutrilite had the first multivitamin tablet ever sold in the United States and Van Andel and DeVos seeing the potential of this product signed up as distributors. After attending a Nutrilite conference in Chicago a few months later Van Andel and DeVos decided to go into distributing Nutrilife on a full time basis.10 Later that year Van Andel and DeVos set up Ja-Ri Corporation in an attempt to add more products to the Nutrilite range they were selling by importing wooden products from South America.11 They introduced what is called the multi level concept of marketing where distributors would be given an extra commission on sales made by people they recruit in addition to the margins they make from their own sales, plus another commission based on the sales volume they and their recruited sellers achieve.12 By 1958 they had over 5,000 distributors.

Van Andel and DeVos with some other top distributors looked into how they could get more products to sell through their multi level marketing networks in addition to Nutrilite and formed the The American Way Association to represent distributors.13 Van Andel and DeVos bought the rights to manufacture and market a product called Liquid Organic Cleaner (LOC) and subsequently formed Amway Sales Corporation. In 1960 they purchased a 50% interest in the manufacturer of LOC, ATCO Manufacturing Company in Detroit and renamed it Amway manufacturing Company. In 1964 all the companies under the AMWAY banner were consolidated into Amway Corporation. Amway expanded into Canada (1962), Australia (1971), United Kingdom (1973), Hong Kong (1974), Germany (1975), Malaysia (1976), Netherlands (1978), Japan (1979), and to another 45 countries over the last 30 years. Amway is one of the largest privatively owned companies in the world today with sales of USD 8.9 Billion in 2009.14

3. The Post World War II Period

Within the first decade of the Second World War more than half American households owned cars, where Ford, General Motors, and Chrysler dominated the market. The automobile very quickly became a concentrated industry based at Detroit. This promoted the growth of specialist manufacturers like A.O. Smith, Bendix, Bosch, Electric Autolite, American Axle & Manufacturing Holdings, and Johnson Controls, etc. which carved out extremely narrow specialist niches. The automobile manufacturers also developed networks of dealers and service centers. The future role of the automobile as a means of travel was greatly enhanced when the US Congress passed the National Highway Act in 1956 to build four lane interstate highways across the United States. Just what the railroads did in the 19th Century, the automobile was going to do in the 20th century opening up the way for passenger and freight travel by road.

As the highways opened up travel between towns and cities, restaurants were needed for people to eat while traveling. Ray Kroc just quit his job at 53 as a paper cup salesman to sell a multiple milkshake mixer to restaurants around the United States. One of the restaurants he called upon was the McDonald’s brothers’ store in San Bernardino California in 1954. Mac and Dick McDonald’s drive-in store had an assembly line arrangement that handled fries, hamburgers, and beverages on a mass production basis which was very efficient and allowed the brothers to monitor quality. Kroc also saw that the restaurant was much cleaner than others around America at the time and had a family, rather than ‘hang-out’ type atmosphere that burger joints were notorious for. Kroc envisaged that this model could work successfully all over the United States and negotiated a franchise agreement with the McDonald brothers.15 Within a year Kroc opened a test store in Des Plaines, Illinois developing procedures and checklists right down to how and when to clean rubbish in the car park. From the first store in 1955, Kroc opened more than 200 stores in the first five years and by the mid 1960s was opening more than 100 stores per year. Kroc opened the Hamburger University to train employees to the procedures of making burgers to operating a store. Today McDonalds Corporation is the World’s largest chain of fast food restaurants.

The automobile also changed the way cities developed, now families could live further away from their place of work in newly sprawling suburbs which drove the home construction industry. New suburbs would also create new opportunities for local businesses that supplied groceries and other staples and services to residents, greatly decentralizing retailing in the United States. The new suburbs encouraged the establishment of hardware, furnishing, plumbing, kitchen, white and electrical goods industries to grow. This saw the rise of General Electric consumer products, RCA radios, and Zenith televisions that rapidly expanded to supply increasing consumer demand. Utility companies supplying telephone and electricity became large corporations during this period with rapid increases in demand for basic services.

By the 1950s ordinary people in the United States could afford to travel and the emerging airlines around the world were picking up increased business. Aircraft could fly further in much less time. Aircraft navigation and safety had greatly improved. The Douglas DC 4 and later the much faster Lockheed Constellation were both capable of traveling across the American continent and across the Atlantic directly from New York to London. The development of tracking and weather radar allowed airports to control traffic much more efficiently. Flight was now becoming a common occurrence. This not only led to a growing aviation industry but also led to opportunities to create new tourist industries where locations had suitable vistas and spurred the growth of the hotel industry in major cities.

One entrepreneur at that time Kemmons Wilson saw that hotels around America tended to be dirty, had few conveniences and facilities and didn’t have enough space for children who they charged at the same rate as adults.16 Wilson traveled around the United States with his wife and children staying in many hotels to see what they had to offer. He concluded that people should expect familiar surroundings in the different cities that they stay in, thus a Holiday Inn should be standardized but at the same time have a local theme, clean, predictable, family friendly, and readily accessible to road travelers. He designed what he believed should be a good hotel, opening the first Holiday Inn in Memphis, Tennessee in 1952. By 1968 there were over 1,000 Holiday inns around the United States alone. The Holiday Inn chain set the benchmark and standards for hotels linking them with an international reservation system that later rivals Best Western, Quality Inns, and Ramada Inns had to match.

By the 1950s radio and television was becoming an important part of American culture. Radio during the war had kept everybody up to date with what was happening and radio took the mantle from newspapers as the most important source of news. Radio broadcast stations increased from 900 in 1945 to over 3,000 by 1948. The National broadcasting Company (NBC) and Columbia Broadcasting System (CBS) dominated the airwaves through their own and affiliate stations. Both networks fought to get the best personalities for their various children’s, drama, comedy, mystery, and news programs. Radio advertising became a powerful means to promote products and both networks competed strongly for the advertising dollars. Although experimental television broadcasts began in 1928, regular broadcasting only commenced in 1946 with DuMont Television Network, with NBC following in 1947, and CBS and ABC in 1948. By 1948 more than one million households owned television sets with about 30 broadcasting stations operating in 20 cities around the United States. NBC dominated the early television programming producing similar types of programs to what had been popular on radio. Ownership of television sets grew as they got larger, programming improved and color came in 1954. By the mid 1950s about half of American households owned television sets. Advertisers flocked to this new medium and television was to show Americans that their country was the most advanced technically in the world.

American industry supported by research and development during the war was set to provide a peace dividend to society. Technology affected all aspects of life. Homes ran almost completely on electricity with new inventions like electric garbage disposals in the sink, automatic garage doors and curtains, and a large range of new electrical appliances. Nuclear energy was going to be the power of the future where Lewis Strauss, Chairman of the United States Atomic Energy Commission stated that electricity in the future “would be too cheap to meter.”17 The USSR launched the first satellite Sputnik 1 in 1957 beginning the space race and new medicines and medical procedures were being developed that gave people confidence about the future. Within agriculture too, there were leaps and bounds in technology. Until the green revolution took place in the late 1940s, agriculture relied primarily on traditional methods of production, based on preventative measures and local inputs. Through technology advances during the Second World War, farm productivity improved dramatically. This was achieved through chemical based fertilizers, pesticides, and herbicides, based on petroleum by-products, ironically spin-offs from the chemical warfare programs. This lead to the growth the American chemical companies like Monsanto and Dow Chemical. In addition a number of labor saving and automation inventions and innovations such as the tractor and plough arrays and automated harvesters enabled the development of extensive farming on a much larger scale than ever before, making people believe that the World had food security.

International trade was growing but shipping was inefficient as every package had to be unloaded from a truck or railroad car and lifted by a crane into the hold of a ship and unloaded at the destination in the same way. Malcolm McLean had built up a trucking company from a single truck to a fleet of over 1,770 trucks making his company the second largest in the United States. He saw that the way goods were shipped was totally inefficient and saw great advantages if the whole load could just be lifted on and off a ship, truck and trailer. As trucks on a ship would waste space, McLean refined his idea to just lifting on and off standardized boxes or containers. At the time in the United States the owner of a trucking company could not purchase a shipping line due to antitrust laws. Mclean sold his trucking interests and purchased two shipping lines with the idea of converting the vessels to containerization. Mclean at first converted two old Second World War ships and commenced a container service between New York, Florida, and Texas in 1957. McLean’s company was renamed Sea-Land Service Inc. in 1960. Although the idea was initially resisted by the unions at the beginning, containerization gradually became accepted around the world by the end of the 1970s. Although the idea was not completely new,18 Mclean had refined the concept and put it into practice, which eventually revolutionized the shipping logistics of world trade.

The 1950s came to a conclusion with a decade of continual growth. The American corporation brought a blissful existence to the middle class by employing and providing them with affordable television, entertainment, cars, fast food, and new urban lifestyle in carefully planned suburban situations around a nuclear family that brought conformity.19 The McCarthyism movement of the decade was allowed to grow out of this conformity and organizations became centers of belongingness and subservience to the greater corporate good, rather than individualism and non-conformism where creativity was a group pursuit. Thus during the 1950s the majority pursued a career rather than self employment and entrepreneurship. American business by 1960 dominated the world in so many fields automobiles, aviation, steel, entertainment, broadcasting, shipping, pharmaceuticals, and petroleum, where corporate American was unchecked by government, foreign competition, consumer movements, or class actions.

4. The 1960s

Whereas the 1950s had been an age of conformity, the sixties took on much more complex social and political trends. The sixties was a time when counter cultures developed which created a diverse mixture of views. This period saw modern feminism emerge, the American civil rights movement, and the aboriginal people of Australia finally granted the right to citizenship. However the sixties also saw retrograde events such as the building of the Berlin wall, the Arab-Israeli War, and a continuation of a long dragged out war in Indo-China. Many governments, particularly in Europe and Canada adopted the welfare state model, some becoming mildly socialist in their outlooks. Science moved ahead in leaps and bounds symbolized by the flight into earth orbit by Yuri Gagarin of the Soviet Union at the beginning of the decade and the landing on the moon by Neil Armstrong and Edwin Buzz Aldrin in July 1969. The world heard about the first working laser, watched television transmitted through the first Atlantic satellite, played the first computer video game, and used the first automated teller machine (ATM). Back on the ground US car makers continued to manufacture high horse-powered motor vehicles up until the end of the decade, dominated by the three major manufacturers Ford, general Motors, and Chrysler. The 1960s also saw the end of colonialism in over 30 countries and was a period of under developed and developing economies in Africa and South-East Asia. The 1960s was also the beginning of the era of mass marketing.

Post war America was an age when products were marketed with some promotional support to assist them to sell. This was more as an afterthought rather than being any central tenant to the firm’s marketing strategy. But the 1960s saw a great increase in competition which gave consumers much more choice. In 1958 Ford created a new division to launch a new model called the Edsel. After much fanfare the motorcar failed to live up to sales expectations and sold miserably and was taken out of production by 1960 providing a loss of more than USD 359 Million.20 There have been many reasons given for the failure of the Edsel in marketing postmortems over the years,21 but essentially the car missed the opportunity it was designed and developed for. The market that the car had been developed for changed dramatically before it could be launched. By the time the Edsel came onto the market, the middle price segment was a shrinking market with companies serving this segment battling against becoming insolvent. Studebaker abandoned producing the Packard, American Motors discontinued producing the Nash and Hudson, and Chrysler discontinued the brand DeSoto. Sales in this segment were down as consumers were slowly shifting to smaller cars like the more efficient Volkswagen Beetle. In contrast the Edsel had a powerful engine requiring premium fuel, with very poor fuel economy. The Edsel was just the wrong car at the wrong time.22 It was just too expensive to buy and own.

Although branding was nothing new to America,23 brand management was still in its infancy. Proctor & Gamble in Cincinnati found in the 1930’s that it had a number of successful brands in the same category like Camay and Ivory soaps that needed a new way to manage so that due focus could be given to each brand. The company gave responsibility for total brand management to a single person (product manager) under a brand management system, which took over all decision making in regards to the brand in the company.24 By the 1960s, brand management spread throughout most consumer goods companies and is still a widely practiced functional structuring of a marketing organization today.

Thomas Watson Senior, the founder of IBM realized that for an organization to be profitable, focus must be orientated towards the customer rather than the product. The objective of a company is to serve the customer, rather than become immersed in the product and technology it has developed. Watson developed this concept and embedded it within the core values of IBM which was based on the belief competing vigorously and providing first class customer service was the key to success. This philosophy is successfully used as a strategy in a number of companies around the world today as a source of their competitive advantage, including FedEx, Thomas Cook.

In 1960, E Jerome McCarthy conceptualized the four P’s of the marketing mix; product, price, place and promotion,25 as the most important ingredients in setting marketing strategy. It was not a great breakthrough in marketing thought, rather a convenient way to view strategy. It was developed at a time when mass industrial marketing was growing rapidly and in recent times the marketing orientation of strategy has dramatically changed as the 4 P’s have become much more integrated and other factors from a customer point of view like customer needs and wants, cost, convenience, communication, distribution and relationships are seen as being more important. However, the concept until today is taught in marketing courses around the world and used by management in their marketing strategy development.

Right into the 1960’s most companies in America were production orientated, seeing the market as the means to dispose of their production. This went well until ‘slow downs’ in consumer purchases create stock build ups in warehouses and interfered with production. Theodore Levitt argued that companies should become much more customer orientated in their approach to the market.26 Levitt’s ideas were inspired by Ford providing customers with what he thought they wanted and the rise of General Motors in gaining market share by providing customers with variations of the basic product by providing new colors, more choice and new models. Although Levitt’s ideas were accepted by corporate America in the 1960’s, it was not until the 1980’s that the marketing revolution came to fruition. Marketing departments began growing and the marketing manager became a powerful driver of the company.

Although multinational corporations were not the invention of America, as the early pioneer companies were mostly European, i.e., Bayer (German 1863), Nestlé (Switzerland 1867), Michelin (France 1893), and Lever Bros. (UK 1890), it was now the American companies that were at the forefront of technology that had developed through intensive local competition. The American domestic market aided US firms to become innovative, develop technologies and business methods, plan and execute strategies effectively.27 The major pull to US firms to develop foreign operations was primarily because of high transport costs and the high tariff regimes that many national governments built around their industries to attract local manufacturing. During this decade many leading American firms expanded to Europe, Australia, Latin America, and Asia. One of the side effects of the growth of US corporations abroad was the influence they had on local cultures and societies. There social impact was mainly through the advertising and products they made available and through the new working conditions they offered to local employees.28 Multinational companies also developed linkages that helped to develop local suppliers, sub-contracting, and generally encouraged new entrepreneurial ventures.29

Sam Walton had been in the retail trade most of his life starting his career at a J.C. Penny store in Iowa. He eventually ran a store called Ben Franklin in Newport, Arkansas, going on to open his own store under the Ben Franklin group in Bentonville called Walton’s Five and Dime,30 where he found great success through discounting. Walton first opened a Wal-Mart Discount City Store in Rogers, Arkansas in 1962, and within five years expanded to 24 stores across Arkansas. By 1968 Walton expanded beyond Arkansas and the following year opened a head office and centralized distribution centre in Bentonville, operating with 38 stores, 1,500 employees and sales of USD 45 Million. Wal-Mart had by 1988 upon Sam Walton’s retirement opened up more than 1,600 stores and created jobs for more than 212,000 people.31 By 2010 Wal-Mart has over 8,500 stores in 15 countries under various banners and is considered the world’s largest retailer and public company by revenue.

Sam Walton saw opportunity by cutting costs and lowering prices to consumers as a formula for success. He focused on continuous improvement of efficiency and cost control in a similar manner to John D. Rockefeller did almost a century before him. The high inflation era of the 1970s worked to his advantage as consumers became much more price conscious and willing to go without service, travel long distances, and buy in bulk to save.

Wal-Mart stores had adverse affects on the small retail sector in the area when a new store was opened, demonstrating Schumpeter’s concept of creative destruction.32 Wal-Mart saved American families money on everyday expenditures and created jobs.33 Walton created a new business model now emulated by almost all retail chains in the world that redistributes costs from products they buy and transport to new logistic profit centers. Sam Walton was the richest man in the United States according to Forbes from 1982 to 1988, when his income was partially distributed to members of his family. Today Wal-Mart operates under various banners in Argentina, Brazil, Chile, China, Costa Rica, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, Puerto Rico, South Korea, and the United States.

Mary Kay Ash was a divorced woman with three children and went to work for Stanley Home Products, a direct marketing company based in Houston. She obtained a respectable salary within the firm but resigned when someone she had trained got a promotion above her, which she believed she was entitled to.34 Having left Stanley, she began to write a book which turned into a business plan of what she believed to be the perfect company and decided to start up the company. In 1963 with her son Richard Rogers, Mark Kay Cosmetics was formed with USD $5,000 investment.

Ash focused on skin care which was a market segment ignored by other companies at the time. She believed that simple door to door selling had its day and that the party-plan concept with a beauty demonstration in the homes of housewives that agreed to be hostesses would be the best sales strategy. Ash recruited representatives from suburban housewives who gave clinics on beauty and skin care and performed personalized make-up lessons to participants. As Ash believed that the caliber of the representatives was the key to sales, she put in lots of training, monetary rewards, and special prizes of pink Buicks and Cadillacs, which became a trademark of the company. By 2008, Mary Kay Cosmetics had 1.7 Million representatives worldwide and more than USD $2.0 Billion revenue. Mary Kay Cosmetics now operate in the United States, Australia, Canada, Argentina, Pakistan, Germany, Malaysia, Mexico, Thailand, New Zealand, Guatemala, Taiwan, Spain, Sweden, Bermuda, Brunei, Norway, Singapore, Russia, UK, Brazil, Japan, China, Portugal, Finland, Czech Republic, Ukraine, El Salvador, Hong Kong, Slovakia, Korea, India, Poland, and a number of other countries, with plants in the United States and China.

The 1960s saw a steady company growth within an environment of economic prosperity. There were large investments in research and development during the decade. Research and development since the Second World War started laying the foundation of a new industry that was to have immense influence upon the world. Computer development was currently restricted because of their massive size and limited computing capacity. William Shockley had been heavily involved in research for the war effort and went to work at the Solid State Physics Laboratories at Bell Laboratories with John Bardeen, Walter Brattain, Gerald Pearson, Robert Gibney, Hilbert Moore, and many other scientists working on solid state electronics at the time. They were attempting to improve upon vacuum tube amplifiers and in 1947 Bardeen and Brattain succeeded in creating a point-contact transistor that achieved amplification without Shockley. Bell’s attorneys started the process of patenting the discovery, along with a number of others, all without Shockley’s name as a co-inventor. This angered Shockley who believed his name should also be included as the work was based on his field effect data. He continued his own research secretly to build a different form of transistor based on junctions instead of point contacts, believing this to be more commercially viable. Shockley developed proof of his principals in 1949, resulting in the junction transistor and found a method to manufacture it a couple of years later. The junction transistor became dominant in the marketplace.

Shockley eventually left Bell laboratories and spent some time as a visiting professor at the California Institute of Technology (Caltech). He formed the Shockley Semiconductor laboratories with the backing of Beckman Instruments and recruited some of the best graduates in America. In 1957, a number of researchers left Shockley Semiconductors to join Sherman Fairchild and form Fairchild Semiconductors. Some of them later left to form Intel Corporation, with some leaving again to form National Semiconductor and Advanced Micro Devices.35 Over the course of two decades, a number of Shockley’s employees had founded 65 companies forming the foundation of what is to become known as Silicon Valley.

William Shockley failed to get his three-state device to work, became a controversial philosopher, acclaimed rock climber, in later life became reserved and isolated from his friends and finally died in 1989. Both Fairchild and Texas Instruments working independently succeeded in putting micro-processors onto a single chip and the computer industry could begin to develop in earnest.

At the end of the 1960s the United States was still led by the manufacturing sector, with the steel industry at the pinnacle. However the nature of the market was slowly shifting unnoticed by most US firms. The first signs of trouble were emerging within the steel industry. Wages were spiraling, demand shifting away from steel products, new economies of scale being introduced through mini-mills, profits plunging downwards, and poor management vision was hindering appropriate responses. The US industry took a knee-jerk reaction blaming cheaper imports as the source of their problems. These complaints resulted in the stop-gap measure of having a Voluntary Restraint Agreement to limit imports in the industry, in effect putting blinkers on the stewards of the industry, blinding them to the structural industry changes that were occurring.36 In fact Japanese steel was being produced at 70% of the cost of US steel due to better efficiencies, leading American producers to cry that dumping was occurring, which had little resemblance to fact.37

Finally, American business saw the emergence of the consumer advocacy movement which was going to win some large cases against corporate America in the coming decades. In 1962 Rachel Carson wrote a book called Silent Spring warning of the dangers of pesticides, especially DDT within the food chain, resulting in the banning of DDT. In 1964 a young graduate of Harvard law school Ralph Nader wrote a book Unsafe at any Speed which raised concerns about the safety of General Motors Corvair. American corporations saw a rise in claims for any mishap however remotely associated with their products, supported by industry ‘experts’ in the lawsuits, most often creating bad media publicity. Corporations at first responded by attacking the personal backgrounds of these claimants, which in the GM case led to Ralph Nader filing for damages and winning on appeal USD $425,000 from General Motors. The next decade was to be very challenging for American corporations as the rest of the world began to catch up with them, where all sorts of new constraints and problems were to emerge.

5. The 1970s

The social progression that began in the 1960s continued during the 1970s with people becoming much more politically aware. The author Tom Wolfe coined the 1970s as the “Me Decade”, suggesting that post war wealth has led to self-absorption and people believing in their own immortality.38 This resulted in a new attitude of individualism in stark contrast to the communitarianism of the 1960s. Women became much more economically independent. The hippy movement centered on the United States continued until the end of the Vietnam War and waned, being replaced by groups that advocated world peace, opposed to nuclear weapons, and became hostile to governments and big business. The environmental movement was just beginning with organizations like Greenpeace and Friends of the Earth becoming popular with fringe, alternative and counterculture groups across Europe and the United States.

During the 1970s the Organization of Petroleum Exporting Countries (OPEC) restricted oil production, resulting in radical increases of the oil price in 1973 and again in 1979, which brought petrol rationing in some Western countries. The 1970s saw the phenomena of stagflation, where both inflation and unemployment occurred at the same time, presenting many policy dilemmas to governments around the world. This eventually lead to neo-liberal economic policies in the 1980s which promoted monetary policy, trade liberalization, floating exchange rates, deregulation, and privatization, strongly advocated by the incoming prime minister of Britain, Margaret Thatcher in 1979.

The 1970s was also a time where China began coming out into the world, taking its seat in the United Nations and opening up dialogue and diplomatic relations with many Western countries. Japan early in the 1970s sunk into deep recession due to the oil embargo, but the economy later boomed when corporate Japan took their place in the international arena in the textile, automobile, motorcycle, camera, watch, consumer electronics, fine chemical, and steel industries.39 The 1970s saw a rise in Middle East tensions which were to continue into the new Millennium culminating with the Munich Olympic massacre, a Middle East war, and finally in 1979 a peace agreement between Egypt and Israel brokered by the then United States President Jimmy Carter. America seemed to be held for ransom during the US Embassy hostage crisis, shortly after the Iranian revolution disposing the Shah, who was an American ally. Along with the earlier fall of the Saigon Government in 1975; this portrayed the United States as being weak. The Soviet Union invaded Afghanistan, which was going to greatly weaken the USSR and finally lead to the fall of communist regimes across Europe within the decade.

America was about to pioneer the personal computer. Microprocessor manufacturers became locked in fierce competition developing more powerful and faster processors that created the platform for ever better personal computers. Personal computers would within the space of a couple of decades erode the dominance of companies like IBM that had almost completely dominated the computer industry during the 1960s. What was ironic is that a group of entrepreneurs who in the main did not finish college or university were able to spot the emerging opportunities and exploit them in the 1970s, so much better than IBM.

Two college dropouts, Steve Jobs and Steve Wozniak had assembled a small computer which they called the Apple in Job’s family garage. The original Apple contained an assembly board with about 60 chips, a read-only memory (ROM), a power transformer and a keyboard packed in a case that could be connected to a small television for a monitor. Other machines at the time used either LED lights or teletype machines for readout, which made the Apple 1 the first interactive personal computer around. Jobs and Wozniak sold about 200 units and went on with the help of Ronald Wayne and funding from A.C. “Mike” Markkula to form Apple Computer, Inc. Soon after, they launched the Apple II, hired Mike Scott from national Semiconductor as CEO. By 1980 Apple achieved sales of over USD $120 Million, elevating both Jobs and Wozniak to celebrity status. Apple had joined the ranks of the Fortune 500 faster than any other company in history by making computers easy to use.40 Apple went on to launch a computer that had a mouse and utilized desktop icons as the menu to make computers even easier for people to use. Apple Computer was quickly joined by other companies, including Commodore which launched the Commodore PET in 1977, Atari with the Atari 400 and 800 in 1979, and Tandy with the TRS-80 soon after. By the end of the Millennium there were 2.6 people for every computer on the Earth.

William Henry “Bill” Gates was born to a well to do family, his father an attorney and his mother a company director. During his early years at school, Bill Gates was very interested in the application of computers and continually played around with the Schools General Electric computer, where he learned to program in BASIC. Taking any opportunities to work with a computer, Gates learned FORTRAN, LISP, and COBOL becoming a very competent programmer. At age 17 Gates and his school friend Paul Allen made traffic counters based on an Intel 8008 processor, forming a company called Traf-O-Data.41 In 1973 Gates enrolled at Harvard University and continued pursuing his interest in computing. This is where his work habit of working up to 36 hours straight, then taking a short nap before recommencing work started showing, indicating his dedication.

After reading an issue of Popular Electronics in 1975 that reviewed the Altair 8800 stating that the programming language had a series of bugs in it, Gates and Allen contacted Micro Instrumentation and Telemetry Systems (MITS) to see if the company was interested in their help developing the language and interpreter. Gates and Allen’s demonstration of their BASIC language and interpreter was a success and they formed a company Micro-Soft with MITS and moved to Albuquerque in November 1975. After Gates found out that his BASIC program had gone out to hobbyists before its release, he wrote in the MITS newsletter that MITS could not continue to release free software without payment from the users. This was at a time where the ‘hacker’s ethic’ encouraged the free flow of information to fellow hackers.42 This letter made Gates very unpopular with hobbyists. In 1976 Micro-Soft became independent of MITS, dropping the hyphen in its name, moving back to Washington State, and continued to produce programming language software. During these early years Gates oversaw all business details and personally wrote much of the software, reviewing every line before it went out into the market place.

IBM was preparing to launch its own personal computer using off the shelf components as there was no time to develop their own due to the rapid growth of the personal computer market and their need to get into the market quickly. IBM approached Microsoft to write the BASIC interpreter for the PC. However IBM needed an operating system and negotiations with Digital Research for the CP/M system failed to conclude any licensing agreement. Gates was asked again about the operating system and he recommended to IBM to use 86-DOS, similar to CP/M, which was written for some machinery. After adapting the system to the IBM-PC, Microsoft sold the operating system for a one up fee of USD $50,000 without transferring the copyright. Gates felt that a number of companies would be interested in cloning the IBM-PC and he was right. The sales of MS-DOS made Microsoft a major company within the computer industry.

Gates and Microsoft went on to develop windows that pushed the company’s sales over the USD $1 Billion mark and ruthlessly guarded his market share. Gates had a reputation for being a fiery boss, often going into outbursts and berating his managers. The company also faced a number of antitrust actions, which they often lost. In some ways Gates had a similar ruthless disposition as John D. Rockefeller and by 1987 he was declared the youngest Billionaire by Forbes in history.

Meanwhile within the aviation industry new business models and deregulation were going to change the nature of civil aviation and the airline industry. Frederick Alfred Laker had been involved in aviation since leaving school, working for British European Airways (BEA) and London Aero Motor Services (LASM). Laker later left to develop his business selling surplus WWII aircraft. The advent of the Berlin blockade by the Soviet Union during 1948-49 advantaged Laker as every available aircraft was needed to carry freight to West Berlin. In 1954 Laker commenced transporting cars and their owners in Bristol Freighters from Rochford in Britain to Calais in France. Laker was made an offer by the Airwork group and sold off all his businesses, joining the group. After a merger with another company in 1960, the group became known as British United Airways and Laker became the managing director. Laker built British United Airways into Britain’s largest privately owned independent airline with an all jet fleet.

After a disagreement with the British United Chairman Myles Wyatt in 1965,43 Laker left to form Laker Airways and began operating charter flights with two Bristol Britannia 102 series turboprops. In 1967 he acquired five BAC One-Eleven 300 short haul jet aircraft partly self financed with the balance financed by a consortium of banks. Laker offered a 30% discount to travel agents to encourage them to utilize charter flights which helped create traffic to popular Mediterranean resorts. He carried out a number of cost cutting measures like using reduced thrust for takeoff, faster climbs to optimal altitudes, and limiting baggage to 15Kg rather than the usual 20Kg and passenger numbers to reduce weight and fuel consumption. Laker also set up a hub in what was then West Berlin that focused on taking holiday makers to resorts in the Canary Islands and Mediterranean. In 1992, Laker bought two wide-bodied McDonnell Douglas DC-10s into commercial service.

In 1971 Laker submitted a proposal to the UK’s then Air Transport Licensing Boars (ATLB) to operate a low cost Trans-Atlantic route between London and New York. It was to operate like a walk-on, walk-off service without prior booking. The application was rejected and Laker appealed the ruling and he was eventually granted a license in 1972. However under pressure from the other airlines suffering from the OPEC oil embargo, the British Government revoked the license in 1975. Laker finally got the license reinstated in 1977 and commenced the Skytrain service to New York. Skytrain was an immediate financial success in the first year of operation,44 leading to expansion of new routes. Laker became very popular with the public through undertaking a series of publicity stunts (Eglin & Ritchie 1980). Skytrain continued to expand its fleet with another five DC-10s delivered from December 1979 onwards to cater for the growing number of destinations. A further ten Airbus A300s were ordered for a planned intra-European Skytrain.

However Laker’s expansion had been too rapid and become very difficult to fund, as the firm did not have any significant assets and was facing growing interest repayments, and declining traffic due to the 1980-81 recession. Laker also suffered from the grounding of his DC-10s due to an American Airways crash at Chicago’s O’Hare airport in 1979.45 Laker was also the victim of price cutting by the major airlines resulting in an out of court settlement for a suit for antitrust breach. After going bankrupt, Laker tried to reestablish the airline with a public float,46 but after a short restart the airline closed for good in 2005.

Sir Freddie Laker saw the opportunity for low cost travel but had to battle policy, bureaucracy and even bullying by existing competition to create the first low cost, no frills airline in the world. His competitive strategy was based on developing high aircraft and staff productivity, low costs by reducing aircraft turnaround times,47 and seeking niche customer markets. Sir Freddie Laker was a pioneer showing up the complacency of the established industry protected by regulation and benefiting the customer greatly. Laker was followed promptly by Southwest Airlines with a modified business model, which has been emulated by so many other low cost airlines since including Easy Jet, Ryanair, Westjet, Air Asia, Virgin Atlantic, Virgin Blue, Jetstar, Cebu Pacific, Nok Air, Freedom Air, Volaris, and Pegasus Airlines.

From a very young age Frederick Wallace Smith had a love of flying and also saw the lack of accountability the post office and freight companies had with letters and parcels they carried.48 At the time mail was monopolized by the post office and parcel freight by Emery Air Freight and Flying Tigers, where an effective oligopoly existed. In 1970 Smith purchased a controlling interest in Ark Aviation Sales and traded in used jets making a good profit in the first year. He still saw the deficiencies in the air freight market and used his USD $4 million inheritance to start up Federal Express with a consortium of investors and a bank providing finance. The company raised USD $91 million, the biggest single start-up in American history in 1971. Federal Express started a service to 25 American cities using 33 French Dassault Falcon 20 executive jets, as their small sized excepted Smith in the need to comply with Civil Aeronautics Board (CAB) requirements for air forwarders. Smith modeled a hub system based on the concept of a bank clearing house where all parcels would come to a central hub located in Memphis, Tennessee and then be dispatched to their destination. Federal Express took the initiative and guaranteed a 24 hour delivery service which competitors had not been able to achieve at the time.

Federal Express had a rocky beginning with Smith forced to sell his private jet and staff often being forced to leave valuables as a deposit for fuel at airports. However in 1974, a strike at UPS gave Federal Express a virtual monopoly on some routes for a short time, giving the company the opportunity to show customers its reliability and win over customers. After deregulation the company purchased much larger aircraft and expanded its routes and services, revolutionizing the parcel service and challenging the monopoly of the post office.

Later on in the decade, the airline industry began to become deregulated. At this stage many ‘flag carriers’ were actually owned by their respective national governments which had a vested interest in restrictive regulation. Some airlines also began leaving the International Air Transport Association (IATA) which had very strict regulations about what could and couldn’t be done by airlines. Leaving IATA benefited many airlines like Singapore Airlines which through enhanced services were able to grow substantially during the next decade.

Until the 1970s American business had been competing among themselves with a great deal of predictability. The rise of Japan from the ashes of World War Two was seen as one of the miracles of business in the second half of the Twentieth Century. Japan had to overcome the complete devastation the allied bombing had done to the factories, its lack of resources, language, and finally image. Japanese companies employed very precise marketing practices at a time when American manufacturers thought they knew everything about marketing.49 Japanese companies were to employ their style of market selection, market entry, market penetration, and market maintenance that made American executives ponder about this new Japanese success. Japanese companies were not frightened to buy market share through very heavy media campaigns that could not be equated to the percentage of sales like American firms practiced, and straight out buying up of their competition.50

Many reasons have been attributed to the success of Japanese business over the years. Most probably one of the important reasons behind Japanese successes in the market place was the complacency of their competitors and failure to seek and exploit new opportunities which made them vulnerable. What American business didn’t see, Japanese Business did, and they acted upon what they saw. The secret to Japanese success was seeing new opportunities that were customer based, applying new technologies to these opportunities, redefining the relationship between cost and quality at the production level, and carefully developing complex business strategies and implementing them very tightly.

The Japanese success was limited to a number of industries where they had a competitive advantage, listed in the introduction to this decade. The automobile is perhaps the best example of the Japanese rise to dominance in an industry, where Japan overtook Germany as a producer of motor vehicles in the 1960s and finally overtook the United States in 1980. In the 1960s Japanese cars were thought of as cheap and of low quality, a decade later they were considered to be fuel efficient, high quality, reliable, and trouble free. Brand names like Toyota, Datsun (Nissan), Mazda, Honda, Subaru, and Mitsubishi rose to the fore gathering high consumer loyalty. Japanese manufacturers selected the small-car segment that the American industry had ignored with fuel efficient vehicles with more standard items than the American models.

This also occurred in the motorcycle industry dominated in the 1950s in the UK by BSA, Norton, and Triumph, Moto-Guzzi in Italy, and Harley Davidson in the United States. Honda had entered the US market in the 1950s and by 1970 was the undisputed market leader in motorcycles. Honda developed an aggressive sales distribution network with a wide service support network. Later Yamaha and Suzuki also entered the market focusing on the young generation.

After the Second World War the Japanese electrical industry was technically backward and produced inferior products to their international competitors in the 1950s. They began buying up technical licenses from international companies which enabled them to learn and improve upon the new technologies. By the 1960s Japanese products began to surpass their competitors. Companies like Matsushita, Toshiba, Hitachi, Mitsubishi Electric, Sony, and Sanyo fiercely competed domestically and then internationally. This was repeated in the appliance industry with Hitachi, Toshiba, Mitsubishi, Sharp, and Sanyo and in the watch industry by Seiko, Citizen, and Orient, which had learnt to produce high precision and high quality timepieces at a low price. Japanese companies also had great success in the camera industry in the single lens, reflex cameras that took over from German camera manufacturers. Japanese companies also dominated the steel, shipbuilding, semiconductor, robotics, and copier industries.

By the end of the 1970s US industry was beginning to realize their own vulnerability and was looking for answers. The regulatory environment was going to be continually eased fostering a more competitive environment, bringing uncertainty into the next decade. Economic uncertainty also rose with growing unemployment. Society failed to learn the lessons of the two oil embargos and look for alternatives to an oil based lifestyle. The cost of homes and mortgages was at an all time home making it difficult for small entrepreneurs to start up. The era of greed was just about upon us with corporations losing great creditability as consumers grew weary and lost faith in them.

6. The 1980s

The beginning of the 1980s was characterized by low/negative growth, rising unemployment, high inflation and interest rates, where a number of countries were going through debt crises. However many corporations grew exponentially through acquisition and merger making them stronger and wealthier than they have ever been before. At the national level many underdeveloped countries attracted manufacturing industry that greatly aided in their development and economic growth, particularly in Mexico, East and South-East Asia. In Eastern Europe the new Soviet policies of perestroika and glasnost gave countries within the Soviet Block new economic freedoms where Poland, Hungary, Czechoslovak experienced uprisings, while Nicolae Ceausescu was overthrown by popular revolt in Romania. The Berlin Wall came down in 1989 symbolizing the end of communism in Eastern Europe. The United Kingdom and United States under the leadership of Margaret Thatcher and Ronald Reagan respectively moved towards a laissez-faire economy through privatization, deregulation and use of monetary policy over fiscal policy, allowing the exchange rate to float freely. The European Union continued to enlarge with the admittance of Greece in 1981 and followed by Spain and Portugal in 1986.

The age of the computer was arriving where many tasks in organizations like word processing replaced the typewriter and home ownership of personal computers was on the rise. However due to the increase in home PC ownership, video console games died out by 1983, but rose again in the late 80s with a new generation of graphics enhanced game boxes produced by companies like Nintendo and Sega. This showed the market volatility of technology based industries that could very quickly rise and just as quickly dissipate into some other form of technology – something that would be seen many times in the computer and mobile phone industries later on.

The American automobile industry continued to suffer with many of the large corporations nearly going into bankruptcy. This was exacerbated by their still unclear future directions, poor quality control, an economic downturn, and competition from Japan. During this decade the Korean car Hyundai made its appearance onto the US market in 1986.

The world underwent massive population growth during the 1980s, particularly in Sub-Saharan Africa, the Middle East, and South Asia. The 1980s saw the beginning of the AIDS pandemic, leading to some backlash against certain minority groups. However it was in this decade that the world had been able to cooperate and work together to solve the problem of depleted ozone around the South Polar cap. Western societies began to adopt the concept of political correctness as opposed to showing prejudice to minority groups in society, which influenced media content.51 Society became less tolerant of smoking, opposed to nuclear power after the Chernobyl disaster in 1996, more accepting of gay rights, and interested in recycling and ‘green’ policies. Consumers also became brand conscious with a bias towards luxury brands over previous decades but at the same time frequented discount and factory outlets for bargains. However the 1980s saw a streak of selfishness to it which is probably best epitomized by the phase “greed is good”, spoken by Gordon Gekko in the Oliver Stone movie of that decade “Wall Street”.

Enter Tom Peters. Peters was co-author of a book written at a time when Japan had severely challenged America’s business dominance with many believing that many other industries were vulnerable to this Japanese “attack”. Tom Peters and Robert Waterman were employees at Mckinsey, one of the premier management consulting firms in the United States. They carried out research to identify common characteristics of successful companies, based on selection criteria of six financial measurements. Peters and Waterman called in two academics Richard Pascale and Anthony Athos to assist them make sense of the data and select the important characteristics of success. Strategy, structure and systems had been agreed upon and Pascale suggested style and shared values to complete five components of the Seven S Framework. After some weeks of discussion skills was added to the framework to make up six components. The seventh was decided upon as sequencing, but later replaced with staff. Peters was also proposing adding power, but this didn’t eventuate.52

Their basic conclusion was that excellent companies exercised commonsense and kept very close to the business basics.53 The book opposed analytical management that relied on numbers to make decisions. Peters and Waterman emphasized ‘mindset’, ‘autonomy’, and “culture’.

The Seven S Framework was featured in Peters and Waterman’s book In Search of Excellence, published in 1982. The book was far from being an academic piece of literature and written in a popularist format, easy to read with lots of stories to get the messages across. Even though the Seven S Framework was sharply criticized for making organizational behavior simplistic, akin to an advertising agency developing slogans and that many of the excellent companies described in the book are not performing well now,54 the book had many relevant messages based on eight main themes, in a chapter by chapter format, which came to corporate America at the right time;

1. A bias for action, active decision making - 'getting on with it'.

2. Close to the customer - learning from the people served by the business.

3. Autonomy and entrepreneurship - fostering innovation and nurturing 'champions'.

4. Productivity through people - treating rank and file employees as a source of quality.

5. Hands-on, value-driven - management philosophy that guides everyday practice

- management showing its commitment.

6. Stick to the knitting - stay with the business that you know.

7. Simple form, lean staff - some of the best companies have minimal HQ staff, and

8. Simultaneous loose-tight properties - autonomy in shop-floor activities plus centralized values.55

It was reported nearly two decades later that Peters admitted that he and his co-author falsified the underlying data used in this groundbreaking book, but this was later denied by Peters.56 Nevertheless, given all the criticisms In Search of Excellence was the top selling management book of all time and ushered in the new era of management gurus, management fads, and ‘the quick fix’ mentality. Tom Peters is the most highly demanded speaker in the management circuit, itself a new industry. Peters in his way of putting things has managed to inspire many and bring up the ‘management culture phenomenon’. However, although most managers at the time had a copy on the bookcase behind their desk, actually how many read it and were able to implement any of the ideas was another thing.

Tom Peters as an influence on management thought continued with his books, more recently focusing on personal responsibility in relation to the new economy; A Passion for Excellence (1985), Thriving on Chaos (1987), Liberation Management (1992), The Tom Peters Seminar: Crazy times for crazy organizations (1993), The Pursuit of Wow! (1994), The circle of Innovation: You can’t shrink your way to Greatness (1997), The Brand You50 (1999), Re-imagine! Business excellence in a disruptive age (2003), Talent (2005), Leadership (2005), Design (2005), Trends (2005), and The Little Things: 163 ways to pursue EXCELLENCE (2010).

On the night of 2-3rd December 1984 at the Union Carbide plant at Bhopal, India, a gas leak occurred and exposed thousands of people to the deadly chemical methyl isocyanate leaving thousands dead. The company was blamed for taking short cuts in the production of pesticides, having inadequate safety and emergency procedures, storing excessive amounts of toxic chemicals above safety levels on site, having malfunctioning warning systems, and being located too close to densely populated areas.57 The disaster led to long and protracted litigation, criminal charges against the management, and much public condemnation.

Later near the end of the decade an oil tanker the Exxon Valdez while traveling through Prince William Sound in Alaska struck Bligh Reef and spilled an enormous amount of crude oil into the sound, the largest oil spill in history. Exxon was heavily criticized for its inadequate response to the disaster.58

A number of court cases occurred during the 1980s bringing a new term “insider trading” to public attention. These cases led to the public attention that the ‘corporate highflyers’ who have access to information that the ‘average person in the street’ does not have are able to increase their own personal wealth significantly and unfairly. That coupled with the media coverage of outrageous corporate salaries greatly disenchanted the public about corporate leadership.

This was reinforced through the news footage of the lavish lifestyles of corporate leaders. For example in Australia, Alan Bond an entrepreneur in Western Australia, famous for his 1983 high profile win of the Americas Cup with the yacht Australia II, an elite sport, ended up being sentenced to seven years jail after pleading guilty for using his controlling interest in Bell Resources to deceptively siphon off AUD $1.2 Billion into the accounts of Bond Corporation. Another entrepreneur Christopher Skase after his firm Qintex purchased the Seven Television Network, Hollywood’s MGM Studios, the Brisbane Bears Australian Rules Football Club, and developed the Mirage Resorts in Port Douglas, putting the small town on the world map, suffered badly from rising interest rates in 1989, contributing to Qintex’s collapse. Skase and his wife, well known for their lavish lifestyles fled to Majorca Spain after parceling up their personal collection of antiques, becoming Australia’s most wanted fugitive. Christopher Skase died in Majorca before the authorities could gain his extradition for trial back in Australia.

Prior to the above disasters and scandals, corporations were portrayed as law abiding and patriotic entities that personified freedom and ethics.59 People found that in some cases nothing could be further than the truth. Previously corporations had only very superficially been scrutinized about their basic ethics, but these disasters and scandals led to the beginning of corporations highlighting their ethical standards in what was later going to be known as Corporate Social Responsibility (CSR).

Anita Roddick was one of the early entrepreneurs to create and build a company based on ethical consumerism and Fair-trade.60 In the 1970s Roddick was on holiday in America and visited a shop called The Body Shop in Berkeley California run by sisters through marriage Peggy Short and Janet Saunders. Their ideas inspired Roddick to open her own shop in Brighton England in 1976. In 1987 after some negotiation, Roddick bought the rights to the name from Short and Saunders for a reported £3.5 Million.61 Anita’s husband Gordon Roddick worked out a franchising system which would enable the couple to open many shops around the United Kingdom and overseas.62 By 1991, The Body Shop had over 700 stores and by 2004 over 2,000 stores serving close to 80 million customers around the world. Roddick sold the business to L’Oreal in 2006 for £652 million,63 a decision that many criticized her for appearing to go against her principles.

The Body Shop was one of the early businesses that built their branding upon ethics. During Roddick’s stewardship of The Body Shop, she ran many social campaigns about ethical issues including banning animal testing, recycling, the raising of women’s self-esteem and stereotyping of women, saving the whales campaign with Greenpeace, and promoted fair-trade. In an interview before her death, Roddick claimed the The Body Shop developed from a series of brilliant accidents, had a great smell, funky name, and started in a hot year where people needed lots of sun-block lotion.64 Roddick showed that firms could charge premium prices for ‘integrity premiums’ and ‘packaged idealism’ marketing strategies that would be successfully used by a number of other companies in the coming two decades.

However companies relying upon ethics in their branding are not beyond scrutiny and The Body Shop was no exception. Jon Entine reported that Anita Roddick had just copied the name and concept from the shop in Berkeley California, including store design, labeling, promotional materials, and overall marketing concept, including individual product lines.65 Her stories of traveling around the world looking for new products from indigenous communities were mostly fabricated as she preferred to buy at the cheapest price and only a very small proportion of products sold in The Body Shop originated from her projects or were Fair-trade products. Entine continued to report that most of the ingredients in products with not natural and Roddick herself did not seem to personally care much about these issues and in the first 11 years of The Body Shop operation the company gave nothing to charity. Entire used the term ‘greenwashing’ to depict companies using ethics and sustainability issues to cynically gain sales and that companies extolling ‘social responsibility’ may not in actual fact be operating any more socially responsible than other companies.

The economic growth of the 1980s saw a wave of mergers and acquisitions that was going to continue to become a permanent feature of the corporate landscape. Mergers and acquisitions started increasing in the 1980s because of the slowly relaxing regulatory environment, the development of the European Union as a single jurisdiction and market, and the easier access to funds through emerging pension funds, junk bonds, and underwriters. 1980s mergers and acquisitions consequently tended to be much more leveraged than they were in later decades. Some deals were fiercely resisted while some were friendly to achieve quick growth and synergies.

One of the largest leveraged buyouts in history was the merger between R. J. Reynolds Tobacco Company and Nabisco in 1985 and then the hostile and bitterly fought takeover of RJR Nabisco by Kohlberg Kravis Roberts & Co. three years later. In 1989 Philip Morris Corporation purchased Kraft for USD $12.9 billion and merged Kraft with their General Foods Division. General Motors purchased Hughes Aircraft Company from the Howard Hughes Medical Institute for USD $4.7 billion. Gulf Oil, one of the seven sisters, merged with SOCAL and rebranded the company as Chevron in 1985, RCA was taken over by General Electric in 1986, US Steel acquired Marathon oil in 1982, and Burroughs and Sperry merged in 1986 to form Unisys in 1986, changing the Fortune 500 listings dramatically.

Generally firms merge or acquire another firm to achieve quick growth, achieve some forms of synergy between the two operations such as cost savings through combining administration, production, and sales forces, etc, achieve some diversification like the tobacco companies tried to do due to long term uncertainty about their major product cigarettes, add to their product portfolios, horizontally diversify, acquire intellectual property, buy market share, or vertically integrate their business. However many mergers and acquisitions don’t work out as planned and failed to bring the financial results expected. Very often in mergers that take a firm away from the core business there is often a failure to understand the new industry. In acquired companies, the acquiring company’s executives may act as conquers and lose many talented people and value from the acquired company. There can also be a clash of different cultures and values between the acquiring and acquired companies. When companies merge with similar companies carrying similar product ranges, customers may rationalize the products they purchase from the new company, resulting in a loss and decrease of overall sales. Finally as was the case in General Foods after the Kraft takeover, the effort and time needed to consolidate the merging of the two companies takes focus away from new product development, which was the strength of General Foods and the market in general.

Outsourcing of goods and services from other firms and/or individual contractors rapidly grew in the 1980s as firms looked at new ways of cutting costs, increasing efficiencies and improving quality. In the 1960s many major corporations acquired goods suppliers or other service providers as a means to save costs through vertical integration. However after going through this exercise most companies found that dedicated suppliers actually raised overheads, lowered innovative creativity, became complacent toward their captive customer, and had difficulty expanding the divisions due to hesitancy of competitors to purchase from a company owned by another competitor.

Companies utilized bureaus to undertake their computing needs as mainframes, mini-computers, and software was very expensive at the time and the ability of micro computers to undertake corporate accounting, retail, and production management had not yet been achieved. Companies that had their own computer systems would hire contractors as programmers, as it was more expensive to have them as fulltime staff. Likewise companies that had in-house delivery logistics also found it cheaper and less worrisome to hire outside logistic firms. Even warehousing was contracted out to third parties. On the sales side, sales brokers and merchandising was also contracted out to third parties, sometimes ex-employees who had specifically left to undertake contractual services for their former companies. The advantage for companies that outsourced was that it could get rid of ‘hidden costs’ that go with employing fulltime staff and provide certainty about monthly costs. Companies and organizations with large revenues would be able to be managed by relatively few people with a minimum number of employees. The outsourcing phenomena added greatly to the growth of opportunities for people with specific skills and networks within the service sector.

On Monday 19th October 1987 equity stock prices in Hong Kong started falling dramatically, spreading through all the markets in the world during that day. By the end of ‘black Monday’ the Dow Jones Industrial Average had dropped 22.61%.66 Within the next 10 days almost 50% of the value of the world’s equities had been eroded. There is a great deal of debate about what caused the crash, although once it started electronic trading and psychological factors contributed to the downward momentum. The effect of the crash was to severely financially strain business in repaying extremely large loans due to relatively liberal lending regime of the 1980s by banks and other financial institutions. This led many firms into bankruptcy and liquidation putting strain on banks, finally leading to a major recession in 1990. One of the legacies of the 1980s was that leveraging would be more conservative in the next decade.

7. The 1990s