BNM interest rate hike could be devastating for the Anwar led government

Rate rise will increase hardship within the lower to middle income household strata

Updated 11.00am 5/5/2023

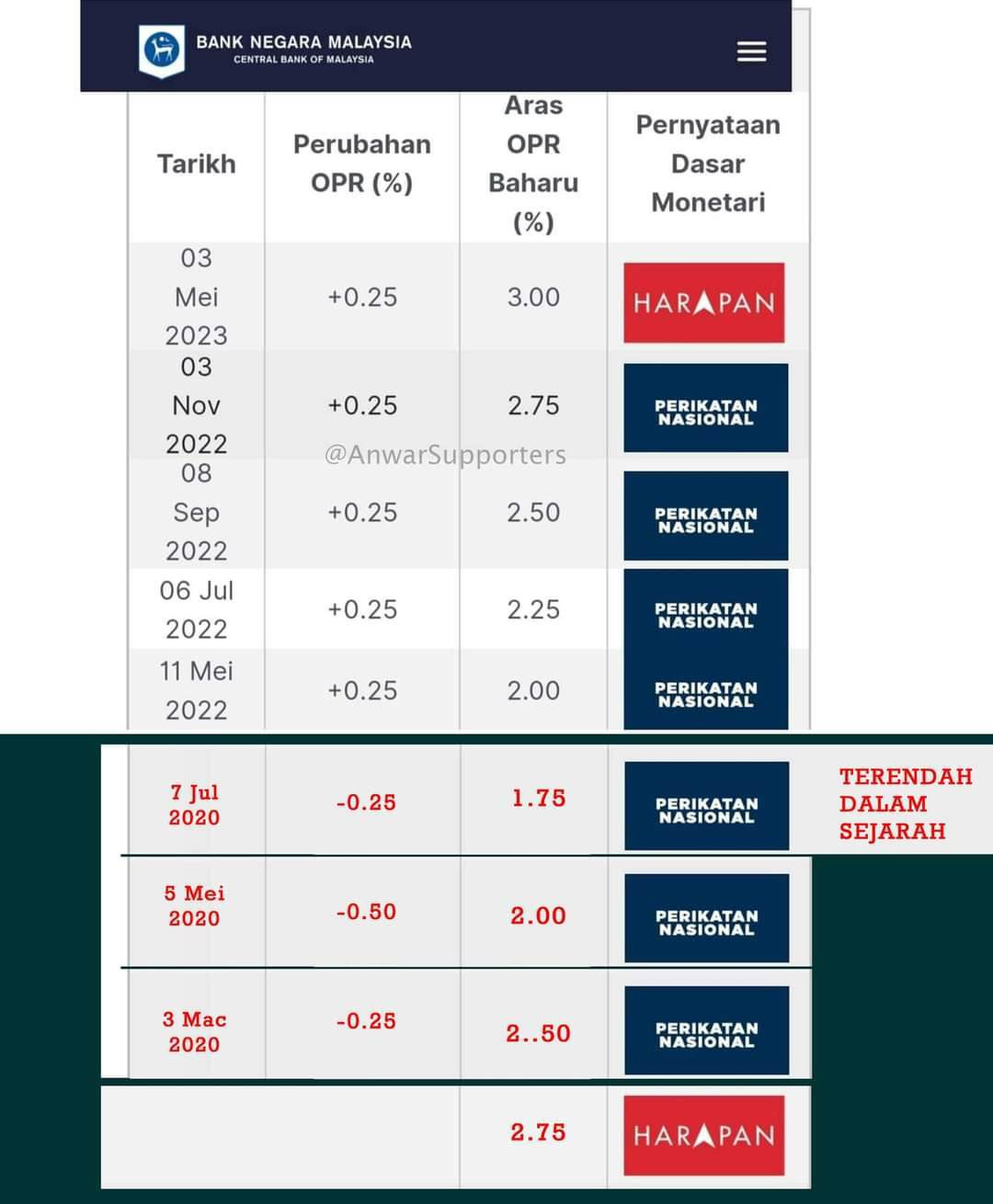

The Monetary Policy Committee (MPC) of Bank Negara Malaysia (BNM) has followed most other international central banks and raised the Overnight Policy Rate (OPR) by 25 basis points (bp) to 3 percent. This is the first time BNM has raised interest rates, since November last year, at a time the MPC expects economic growth to continue. The MPC is holding to the forecast that domestic demand will continue to expand during 2023.

Local banks were very quick to respond to the BNM move, where RHB, Public Bank, Affin Bank, Maybank, and Hong Leong Bank have all raised their lending rates to between 6.45 to 6.75 percent. The Islamic banking sector has followed suit.

This brings interest rates back to November 2019 levels.

However, there are a number of uncertainties over the next few months, where Europe and the United States may slide into recession, and the Ukraine conflict is continuing and looking like being a long-term war. Households and businesses are not as robust as they were in 2019, still suffering financial strain during the MCOs during the pandemic, where many workers lost income and jobs for long periods of time, while increasing their debt levels. The level of savings within the community is now very lower, as households have not yet had time to replenish them.

Whilst, BNM is upbeat on domestic economic growth, there are a number of potential collateral effects from the OPR rate hike that will affect households and SMEs alike, which could strain both sectors, and pull down the positive trajectory of the economy. If this was to occur, it would be devastating to the Anwar Ibrahim led government.

The rate risk will start to flow-on to mortgage holders within the next month, who will have to pay more to service their loans. This will strain many low to medium income earners who are already struggling to make ends meet through the current bout of rising living costs.

These raised rates could also dampen demand for housing, as prices rise and the cost of money increases. These interest hikes will also eventually flow onto rents, making it more expensive to rent a house.

While the interest hikes will increase household debt, it will also have the effect of creating lower relative wages, and thus lower aggregate household demand across the nation. This will flow on to businesses, which could experience lower demand for their products and services later in the year.

SME costs will also rise through the increased cost of debt. This could eventually be passed onto consumers, adding to the general rate of inflation. Businesses may find it more difficult to borrow. Rising debt will also squeeze SME liquidity, slowing down the circulation of money, making it more difficult for businesses to settle their trading debts with other businesses. This could lead to a general credit squeeze within the economy.

The effect of higher interest rates, relative lower income and higher debt will also increase the wealth gap between lower-middle income and upper-middle income groups. This means more will fall into relative poverty, if a downward spiral of debt and financial hardship occurs.

If aggregate household demand and tourism flattens instead of grows as forecast, there is a probably that interest rate rises will pull Malaysia into a light recession. There will not be any long-term increase in the strength of the Ringgit against its trading partners, because most have also raised their own interest rates, leaving the Ringgit with no comparative advantage over other currencies. Major economic indicators are already indicating an economic slowdown in line with the general global slowdown.

This interest hike will hit the very groups that need financial assistance most. These are also the groups who supported Pakatan Harapan. The prudence of BNM in raising interest rates just before 6 state elections, involving 45 percent of the nations’ eligible voters must be questioned. The ‘unity government’ is now campaigning to large sections of the community, who have been dealt a big financial blow from the interest rate rise.

BNM’s decision will cause more financial suffering within the community, where there is a large risk that voters may take their anger out on the government at the coming round of state elections.

Originally published in Focus Malaysia 4th May 2023

Subscribe Below:

Pmx need to come out with policies and programs to reverse this problem and quickly create wealth.

The problem is pmx do not know how.

The majority malay civil servants know but they wont help pmx. Hence pmx is left alone with a bunch of inexperienced menteris like rafizi and fahmi fadhil.

The people will suffer.

No one can get bank loan to purchase properties,no one can operate hotels successfully as the 6 to 7percent borrowing cost is too high.theres no wealth creation.

Pmx is also held hostage politically by dap and umno. He has to obey whatever they tell him to do.

No foreigner dare invest in malaysia as pmx put a thief as dpm of malaysia. They are afraid dpm will steal like thief always do..money from them.