Chartered Management Institute (CMI) UK must be investigated for financial misconduct

CMI annual report confirms my earlier reports on CMI Management & Leadership Sdn Bhd.

Its certainly a black report for CMI this year.

The latest Chartered Management Institute (CMI) annual report in the United Kingdom has highlighted many financial irregularities in CMI Management & Leadership Sdn Bhd in Malaysia. This confirms many of the issues reported earlier on this Substack (see links below).

Its now time for the authorities to fully investigate CMI in the United Kingdom as well as in Malaysia. CMI being a charity in the UK should have a higher standard and duty of care than normal companies. Its now time for those within the management of CMI to be held legally accountable.

Some extracts from the CMI UK annual report are summarised (exerts) below:

· The latest Annual Accounts 2024 for the Chartered Management Institute (CMI) in the UK confirm ongoing financial crisis and a significant bail-out of its Malaysian operations by the UK Charity, following revelations that their activities in Malaysia are in severe financial and existential trouble.

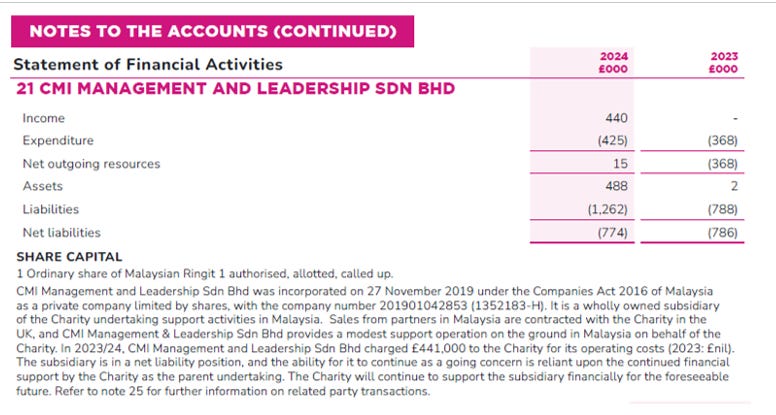

· The Malaysian enterprise of the UK Charity is called CMI Management and Leadership Sdn Bhd and is confirmed as a shell company in the latest CMI Annual Report 2024 which is merely “a wholly owned subsidiary of the Charity undertaking support activities in Malaysia.” according to the CMIs UK auditors (AR p.42)

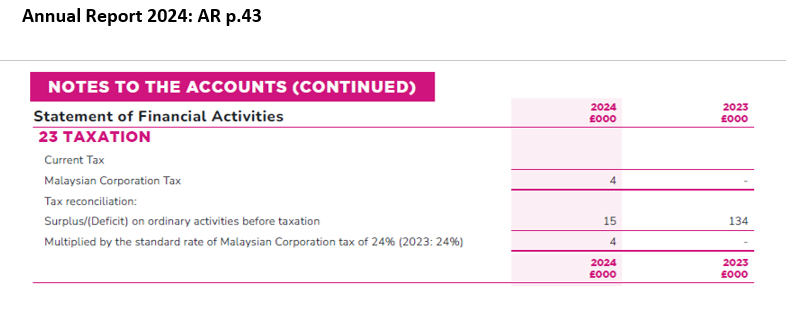

· Since its establishment in 2019 the auditors also report that “CMI Management and Leadership Sdn Bhd has trading losses carried forward of £674,060 [RM3,816,520] at 31 March 2024.” These losses allowed the Malaysian company to avoid tax.

· The latest accounts show that this tax avoidance appears to have been stopped following revelations of the scheme and the UK auditors report records, “However, a deferred tax asset has not been recognised in respect of these losses as it is not considered probable that it will be recoverable against future trading profits in the foreseeable future. (AR p.39) In other words it appears that the auditors have denied using these losses as tax avoidance because they are unrecoverable and “bad debt”.

· The shell company status of CMI Management and Leadership Sdn Bhd is confirmed by the auditor’s finding that it does not have any sales of its own: “Sales from partners in Malaysia are contracted with the Charity in the UK, and CMI Management & Leadership Sdn Bhd provides a modest support operation on the ground in Malaysia on behalf of the Charity.” (AR p.42)

· Beginning this year the auditors report that “the Charity is recharged with the local costs of its wholly owned subsidiary CMI Management and Leadership Sdn Bhd. During the year, the Charity paid £425,000 [RM2,406,340] (2023: £368,000, [RM2,083,610]) of expenses on behalf of CMI Management & Leadership Sdn Bhd and was recharged £441,000 (2023: £NIL).” (AR p.43) Previously these financial transfers were recorded as debt and written off as unrecoverable and untaxable “bad debt.”

· Following revelations of continuing financial losses, CMI Management and Leadership Sdn Bhd final generated an operating profit of £11,000 [RM 62,280] (2023: Operating loss of £368,000) [RM2,083,610] last year for the first time after five years of losses since its incorporation in 2019. (AR p.30)

· To create these “profits,” CMI Management and Leadership Sdn Bhd charged the UK Charity more than it spent in order to post a “profit” and token tax payment of £4,000 [RM22,646]: “In 2023/24, CMI Management and Leadership Sdn Bhd charged £441,000 [RM2,496,380] to the Charity for its operating costs (2023: £nil)” (AR p.42) this compares to actual costs of £425,000 [RM2,406,340] (2023: £368,000, [RM2,083,610]). In other words they over-charged the UK Charity to create a balance which was used to declare a “profit” and record a token tax payment. (AR p.42)”

· Despite these accounting changes, CMI Management and Leadership Sdn Bhd is still in huge debt of £1,183,000 [RM6,697,365]: “The subsidiary is in a net liability position” (AR p.42)

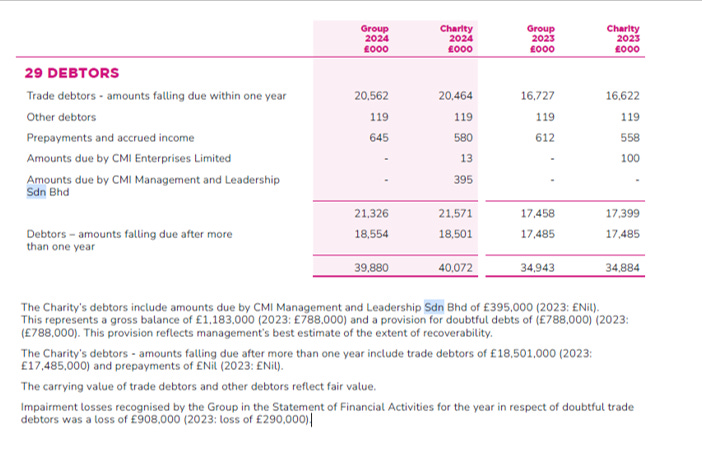

· The auditors confirm that “At 31 March 2024 the amount due by CMI Management & Leadership Sdn Bhd to the Charity was £1,183,000 [RM6,697,365] (2023: £788,000, RM4,461,135). A provision for doubtful debts of £788,000 (2023: £788,000) has been made against this balance.” (AR p.43)

· CMI Management and Leadership Sdn Bhd owes significant debt to the UK charity which is accounted as unrecoverable “bad debt”: “The Charity’s debtors include amounts due by CMI Management and Leadership Sdn Bhd of £395,000 [RM2,236,386] (2023: £Nil). This represents a gross balance of £1,183,000 [RM6,697,365] (2023: £788,000, RM4,461,135) and a provision for doubtful debts of (£788,000) (2023: £788,000). This provision reflects management’s best estimate of the extent of recoverability.” (AR p.43)

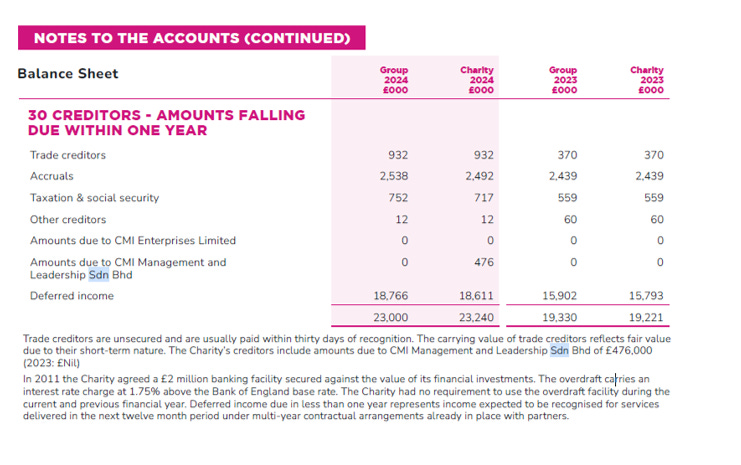

· The debt of CMI Management and Leadership Sdn Bhd falls due within one year despite it having no independent income: “Trade creditors are unsecured and are usually paid within thirty days of recognition. The carrying value of trade creditors reflects fair value due to their short-term nature. The Charity’s creditors include amounts due to CMI Management and Leadership Sdn Bhd of £476,000 [RM2,695,025] (2023: £Nil)” (AR p.46)

· The auditors, BDO LLP in London have concluded that CMI Management and Leadership Sdn Bhd in Malaysia is unable to continue as a going concern on its own: “and the ability for it to continue as a going concern is reliant upon the continued financial support by the Charity as the parent undertaking.” (AR p.42)

· With accumulated debt and losses of £1,183,000 [RM6,697,365] and unsecured debt of £476,000 [RM2,695,025] falling due this year the continued support of the UK charity must be in doubt leading to a significant risk that their Malaysian enterprise might fold as a going concern and exposing 21 higher education partners and 5,000 members to the loss of money, certificates and credibility.

Annual Report 2024: AR p.30

CMI Enterprises Limited is a wholly owned subsidiary offering commercial services in support of the Charity. During the year, CMI Enterprises Limited generated an operating profit of £107 (2023: Operating profit of £142). CMI Management and Leadership Sdn Bhd, also a wholly owned subsidiary of the Charity, registered in Malaysia, provides on the ground support in the Asia Pacific region on behalf of the Charity. During the year, CMI Management and Leadership Sdn Bhd generated an operating profit of £11,000 (2023: Operating loss of £368,000).

Annual Report 2024: AR p.39

9 DEFERRED TAXATION

Deferred tax is provided on temporary differences at the reporting date between the tax bases of assets and liabilities and their carrying amounts for financial reporting purposes. Deferred tax assets are recognised for deductible temporary differences, carry-forward of unused tax credits and losses, to the extent that it is probable that taxable profit will be available against which they can be utilised. CMI Management and Leadership Sdn Bhd has trading losses carried forward of £674,060 at 31 March 2024. However, a deferred tax asset has not been recognised in respect of these losses as it is not considered probable that it will be recoverable against future trading profits in the foreseeable future.

SHARE CAPITAL

1 Ordinary share of Malaysian Ringit 1 authorised, allotted, called uAR p.

CMI Management and Leadership Sdn Bhd was incorporated on 27 November 2019 under the Companies Act 2016 of Malaysia as a private company limited by shares, with the company number 201901042853 (1352183-H). It is a wholly owned subsidiary of the Charity undertaking support activities in Malaysia. Sales from partners in Malaysia are contracted with the Charity in the UK, and CMI Management & Leadership Sdn Bhd provides a modest support operation on the ground in Malaysia on behalf of the Charity. In 2023/24, CMI Management and Leadership Sdn Bhd charged £441,000 to the Charity for its operating costs (2023: £nil). The subsidiary is in a net liability position, and the ability for it to continue as a going concern is reliant upon the continued financial support by the Charity as the parent undertaking. The Charity will continue to support the subsidiary financially for the foreseeable future. Refer to note 25 for further information on related party transactions.

Annual Report 2024: AR p.43

25 RELATED PARTIES

The Charity trades with its wholly owned subsidiary CMI Enterprises Limited. Any profits made by CMI Enterprises Limited are transferred to the Charity under the Gift Aid Scheme subject to sufficient distributable reserves. £107 has been donated to the Charity under gift aid for the financial year (2023: £141). During the year, CMI Enterprises Limited purchases from the Charity amounted to £18,000 (2023: £26,000) and the Charity made a Management Charge of £89,000 (2023: £100,000) to CMI Enterprises Limited. At 31 March 2024 the amount due by CMI Enterprises Limited to the Charity amounted to £13,000 (2023: £NIL).

The Charity is recharged with the local costs of its wholly owned subsidiary CMI Management and Leadership Sdn Bhd. During the year, the Charity paid £425,000 (2023: £368,000) of expenses on behalf of CMI Management & Leadership Sdn Bhd and was recharged £441,000 (2023: £NIL). At 31 March 2024 the amount due by CMI Management & Leadership Sdn Bhn to the Charity was £1,183,000 (2023: £788,000). A provision for doubtful debts of £788,000 (2023: £788,000) has been made against this balance.

Annual Report 2024: AR p.45

The Charity’s debtors include amounts due by CMI Management and Leadership Sdn Bhd of £395,000 (2023: £Nil). This represents a gross balance of £1,183,000 (2023: £788,000) and a provision for doubtful debts of (£788,000) (2023: (£788,000). This provision reflects management’s best estimate of the extent of recoverability.

The Charity’s debtors - amounts falling due after more than one year include trade debtors of £18,501,000 (2023: £17,485,000) and prepayments of £Nil (2023: £Nil ).

The carrying value of trade debtors and other debtors reflect fair value. Impairment losses recognised by the Group in the Statement of Financial Activities for the year in respect of doubtful trade debtors was a loss of £908,000 (2023: loss of £290,000).

Annual Report 2024: AR p.45

Trade creditors are unsecured and are usually paid within thirty days of recognition. The carrying value of trade creditors reflects fair value due to their short-term nature. The Charity’s creditors include amounts due to CMI Management and Leadership Sdn Bhd of £476,000 (2023: £Nil)

In 2011 the Charity agreed a £2 million banking facility secured against the value of its financial investments. The overdraft carries an interest rate charge at 1.75% above the Bank of England base rate. The Charity had no requirement to use the overdraft facility during the current and previous financial year. Deferred income due in less than one year represents income expected to be recognised for services delivered in the next twelve month period under multi-year contractual arrangements already in place with partners.

Subscribe Below:

This is a fradulent "educational" institution set up and operated by Jaffna Tamils just as Sunway was set up by Jeffrey Chua. The difference between Sunway and Chartered Institute of management is that the CMI is smaller. Sunway is a "Bums on seats" institution which boasts the likes of the cash rich Monash University an institution whos vice chancellor (1998) was found to have been involved in plagiarism. It holds open book exams and take home exams like many Australian universities allow these days. Their standards are low evn at the level of medicine.