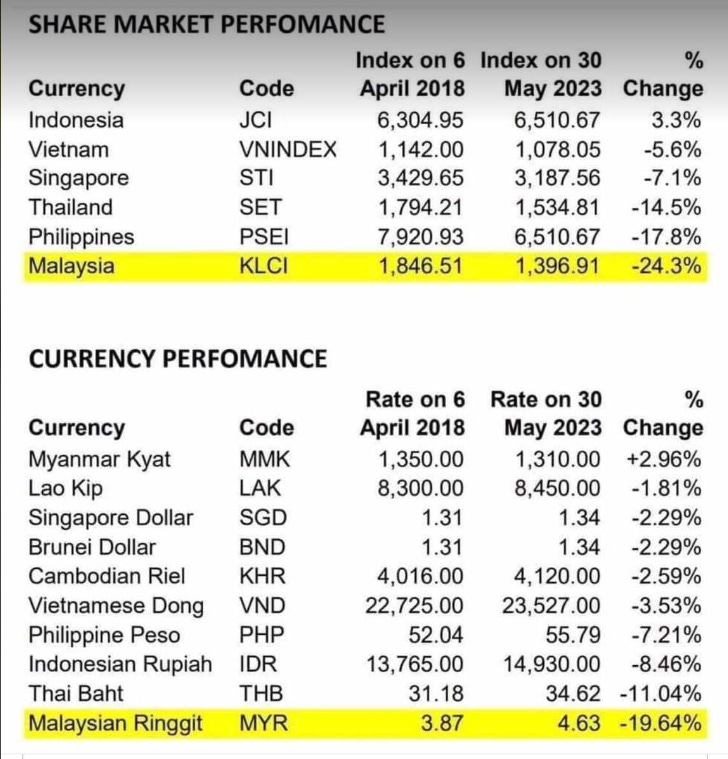

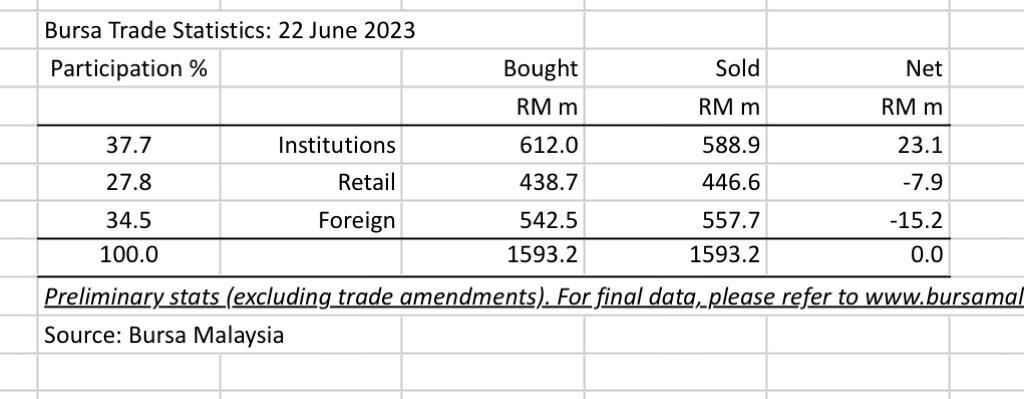

More than RM 2.06 billion has been taken out of the country over the last 10 days. Short-term foreign investment on the KLSE is being withdrawn and repatriated on a daily basis, peaking at RM 94 million last Friday. The equity being sold is mainly taken up by local institutional investors, which are propping up the market, which is the worst performing in the region.

This is a key warning sign for the Anwar government. Today was the 10th consecutive day of capital flight.

While this flight is continuing, foreigners are buying up local real estate at bargain basement prices. Malaysia is getting to a situation where foreign investment is negative.

While these outflows continue, there is a declining in the average daily trading volume, among retail investors, which indicates a massive loss in investor confidence.

This scenario will have grave implications on the Ringgit against the USD, particularly in the short-term. Its now almost certain Bank Negara Malaysia will be forced next month to raise interest rate again, due to the sliding Ringgit. This may pivot the economy towards a recessionary trend.

It now the institutional investors which are propping up the KLSE. Overtime this will stress the liquidity of KWSP, which controls EPF.

This is the government’s last line of defence. They are plugging the floodgates with their hands now.

Subscribe Below:

All Malaysian current politicians are too busy playing politics - not concentrating on the economy given the non stop race and religious flame fanning from Opposition. Probably a lot of cash in stock market is controlled via Tun and Daim's cronies to force an economic slow-down. Anti corruption rhetoric are big-time BS. Seems like everyone is related to someone who is on the take and fear on finger-pointing back to every politician. For Anwar to survive a major operation Lalang - similar to what Prince Salman from Saudi did, to put all the crony businessmen into one hotel and lock them up until they turn over their billions. You will be surprised on the number of unlisted Malaysian Malay billionaires and most of them are politicians.

Thee trend with real estate purchases and skyrocketing prices in certain properties is being noticed in places like Sydney and Melbourne too. Reason? Money laundering on an industrial scale. The Chinese from the mainland fearing an economic downturn worse than what they are already experiencing aree pumping large sums of their ill gotten gains looting their government institutions and placing them in safe havens like Australia. Xi Jin Peng they fear will behave like his mentor Mao and cull the rich when the tide goes out.

In Australia drug barons are also believed to be paying unrealistic prices for real estate properties driving the surge there.

As for the Boursa in KL, well with the conduct of the Bursa over the Air Asia insolvency scandal it is no wonder that even hot money finds KL to be a 'dog' as far as investments, safety of funds, legal compliance, management and reliability is concerned. The Boursa's attitude to Air Asia's failure to correct and re submit their financial statements in time without penalties would have sent shock waves throughout the investment communities worldwide. The impact is beginning to be felt everywhere where compliance failures are noticed.