Fifty years of the New Economic Policy (NEP) hasn’t worked

Budget is expected to reaffirm the NEP

By: Murray Hunter, Lim Teck Ghee, and Ramesh Chander

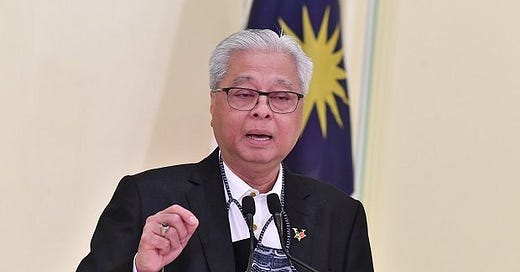

With the annual budget due for delivery on October 29, Malaysia’s government is expected to reaffirm the New Economic Plan, the 1970s-era affirmative action plan for ethnic Malays that has distorted the economy for five decades, a continuation of both macro-economic management and intervention.

The NEP, as the plan is universally known, has skewed wealth creation towards an elite group, as illustrated by the release of the Pandora Papers, the trove of millions of documents liberated by the International Consortium of Investigative Journalists detailing the secret offshore accounts of 35 world leaders, including current and former presidents, prime ministers and heads of state as well as more than 100 billionaires, celebrities and business leaders. Among them are Malaysia’s current finance minister Tengku Zafrul Aziz, as well as former finance minister Daim Zainuddin.

Since the formulation of the NEP, economic regulation has focused on redistributing wealth rather than creating it. This was well hidden during the high GDP growth years but has become much more apparent during the slower growth rates of the past decade.

The 12th Malaysia Plan, released in early October as a five-year development plan, offers no improvement in the GINI index, the measure of economic inequality. While mean monthly income has increased from 2016 to 2019, the overall GINI coefficient has actually increased from 0.399 to 0.407, pointing to a widening of income inequality. This is at a time when Malaysia’s GINI ranking is at the top of Asian inequality.

The issue that needs to be addressed is that the share of the so-called B20, or bottom 20 percent of Malaysia’s income earners, comes to only 5.9 percent of national income, while the T10 (or top 10 percent) share is 30.7 percent of national income. The plan offers nothing to reverse this situation.

The incidence of relative poverty in Malaysia has increased from 15.6 percent in 2016 to 17 percent in 2019, and is continuing to increase. Economic statistics are lagging and may be distorting our understanding of what is happening on the ground. Economic recovery and relief are set to be delayed with little contained within RM12 to assist. Elevated unemployment and inflation are not considered.

Thus, we expect the economy to go into 2022 much worse off. Thus, as former officials with the World Bank, with the help of a longtime development official, we believe the economy has to be drastically redirected. Our recommendations follow:

New Direction

The nation needs to move from wealth and equity redistribution to wealth creation. This requires doing away with creating millionaires, which has created a rent-seeking class of oligarchs, to nurturing a prosperous Keluarga Malaysia (Malaysia Family) as officially expressed. It also means protecting the buoyancy of households through a safety net and creating employment and economic opportunity for all rather than promoting economic rent-seeking opportunities for the connected elite through government intervention and regulation.

With poverty and unemployment increasing, macro policy requires effective microeconomic initiatives to have an aggregate effect. This requires developing and implementing effective programs. The priority areas are building income among the bottom 40 percent; assisting SMEs, which employed 48.9 percent of the workforce or 7 million people before the pandemic began in 2019; providing safety net assistance; and implementing targeted regional and urban development where the poor reside.

One of the key strategies in building income across the B40 is increasing wages, both to reduce poverty and decrease income inequality. This is perhaps one of the most challenging aspects of policy.

The bottom end of the labor market has an estimated 2 million migrant workers who exert downward pressure on wages. In addition, working conditions are extremely poor and even dangerous, indicating a catastrophic failure of the Department of Labor to develop and enforce safety standards.

Focus on SMEs

The next problem is cultural. Jobs traditionally undertaken by migrant workers are seen by today’s younger generation as totally undesirable. Local employers complain about the spasmodic attendance and poor productivity of local employees. Attention must be focused upon SMEs which employ almost half of Malaysia’s workforce.

The RM12 document was scant on identifying the most critical issues facing Malaysia’s 1.15 million SMEs today. The major problems SMEs face include liquidity issues and the inability to grow, access to appropriate technology, the inability to develop relevant skill sets, and lack of ability to collect market information, and gain customers. Countless government programs to assist SMEs have only reached a small number of those in need.

Too many SMES have found the conditions to obtain assistance too difficult, and banks have imposed strict loan conditions, such as collateral, support documentation, and past performance record. Rather than create another agency to assist contractors get paid quicker from the government, a national factoring scheme could be put into place to expedite quicker payments and increase the velocity of money around the economy. There should be a radical shift in education towards part-time to teach basic SME finance, management, marketing, and technology skills.

Industry 4.0 and digitization are well and good, once the nation’s SMEs develop a critical level of health, so they are skilled up and ready to expand. Unfortunately for most of Malaysia’s SMEs, this is not now.

Long extended lockdowns have taken a toll on SMEs, with more than 30,000 closing last year, and the closure of 30 percent of retail shops. Immediate tax relief is necessary to assist landlords’ lower rental and leasing costs to occupying SMEs to assist them to survive.

Safety net Overhaul

For the unemployed, the solution is putting income into their hands. This requires a total overhaul of Malaysian social and economic safety net programs. Some form of universal income-tested, which could be based on a fund or insurance scheme basis, is required to assist those who fall into unemployment, sickness, incapacity, or otherwise fail to earn an adequate income.

According to the economist Geoffrey Williams, a scheme to cover the above contingencies of 1.24 million households currently below the relative poverty line income of RM2,937 per month, would cost RM10.2 billion, or 3.2 percent of the government’s annual budget.

A safety net could be partnered by a universal income-tested pension scheme, built on the current Employee Provident Fund (EPF) system. Currently, 6.9 percent, 2.23 million people are aged 65 or above, and this percentage is growing as fertility and death rates are declining.

According to EPF statistics, 46 percent or 2.7 million workers have less than RM10,000 saved. This means that only a small number of people at retiring age have enough funds to stay out of poverty. This situation is worsening. Overhauling the pension system is a must if a crisis in aged poverty is to be averted in the near future. One approach discussed below could be channeling Petronas profits to the EPF to fund a universal pension scheme.

Development priorities

Today many communities lack sealed road access, clean water, telecommunications, and even electricity. Besides visible poverty, there are many pockets of poverty in Sabah, Sarawak, Kelantan, Terengganu, Perlis, Kedah, and urban areas in all the states, where local authorities and responsible agencies do their best to hide these problems.

There are too many development projects that just become white elephants and assist relatively few, except to provide opportunities for corruption in the development and building process. Community organizations like PAKOS in Sabah that assist remote local communities are shunned as competition by government agencies, when they should be partners.

By far the biggest problem in regional development and poverty eradication is that communities are told what they need, rather than asked what they need. This has caused massive wastages and corruption over the decades. This development paradigm needs radical change.

At the same time, according to the World Bank, between 20-30 percent of the budget for public contracts is wasted due to either mismanagement or corruption. If these leakages could be prevented, this would solve much of Malaysia's fiscal problems, allowing the government to allocate more to income support, pensions, SMEs, and poverty eradication. This should be one of the government's highest priorities.

Civil Service Reform

Malaysia’s civil service is bloated, inefficient, and an environment that is feeding corruption. There is much wastage of financial resources and over-staffing across many ministries and agencies. While the civil service has been automating many jobs through IT, employee numbers have been rapidly growing, rather than declining through increased productivity.

The civil service costs 47.4 percent of the total operational spending within the annual budget. In 2019, this amounted to RM 122 billion. This budget could realistically be cut down by 25 percent or RM30 billion or more without operational loss of efficacy. Staff numbers within the civil service have grown to a bloated 1.71 million employees, even though systems and procedures have been computerized. RM12 plans an even greater expansion of the civil service, mostly for the purpose of monitoring markets within the economy, which is unnecessary.

Government needs to bite the bullet in reducing the size of the civil service and implementing a “flexible and varied” contractual scheme to ease the burden of paying the ever-rising emoluments. In addition, there are many federal and state-owned GLCs which are debt-ridden, loss-making, and their outputs compete with private enterprise providers. These money-losing and debt-ridden GLCs should be identified and closed to save further wastage.

The above savings could be channeled back into safety net assistance schemes to alleviate poverty since the RM12 is claimed to be a Rakyat first approach. Creating a universal income-tested safety net is the redistribution game-changer Malaysia needs right now.

Finally, but not lastly, Minister in the Prime Minister’s department Mustapa Mohamed said the RM400 billion tagged to be spent through RM12 is the highest in Malaysia’s history. It’s not the size which counts but the effectiveness of what is spent that is important. Funding the growth of the public sector, setting up new agencies and departments, and incurring more debt, will be counterproductive.

It is urgent to look at policy innovation, which RM12 unfortunately lacks. There are examples that can be drawn from and utilized within the Malaysian context for the betterment of policymaking. One approach to assist in financing a Malaysian safety net could be by channeling Petronas profits to the EPF to fund a scheme similar to the highly successful Government Pension Fund of Norway.

Covid is forcing change throughout the region and the world. There is going to be an economic scramble and battle to recover. If Malaysia does not gear up with a realistic, competitive, and sustainable economic recovery plan, it will very quickly fall behind the rest of the region. RM12 in its present form has missed this opportunity.

Ramesh Chander is a former chief statistician of Malaysia and a senior statistical adviser at the World Bank in Washington, DC. Murray Hunter is an independent researcher and former professor with the Prince of Songkla University and Universiti Malaysia Perlis. Lim Teck Ghee is a former senior official with the United Nations and the World Bank.

Originally published in the Asia Sentinel 27th October 2021

You can subscribe for free emails of future articles here: