The silent invasion: The rise and rise of BlackRock in Malaysia

BlackRock is a major influence upon the Malaysian economy

Over the last decade US based equities firm BlackRock has become extremely influential within the Malaysian economy.

Most Malaysians probably don’t know what BlackRock is. BlackRock is the largest international investment corporation in the world. It manages global assets worth some USD 10 trillion. Founded in 1988, BlackRock had a dramatic ride to the top of the investment world, playing major investment roles in most national economies, including Malaysia.

Just note: BlackRock owns CNBC

BlackRock primarily invests funds for clients through numerous companies and funds. BlackRock also advises governments and has a close relationship with the US Federal Reserve. BlackRock play’s a major role in what is called an environmental, social, and corporate governance investment (ESG), and has become very active in the renewable energy and environmentally sustainable sectors.

Its also important to note that BlackRock is a major strategic partner with the World Economic Forum (WEF).

BlackRock’s influence within the Malaysian economy

Below is a brief summary of BlackRock’s investments within the Malaysian economy today.

Ownership of Malaysia’s corporations

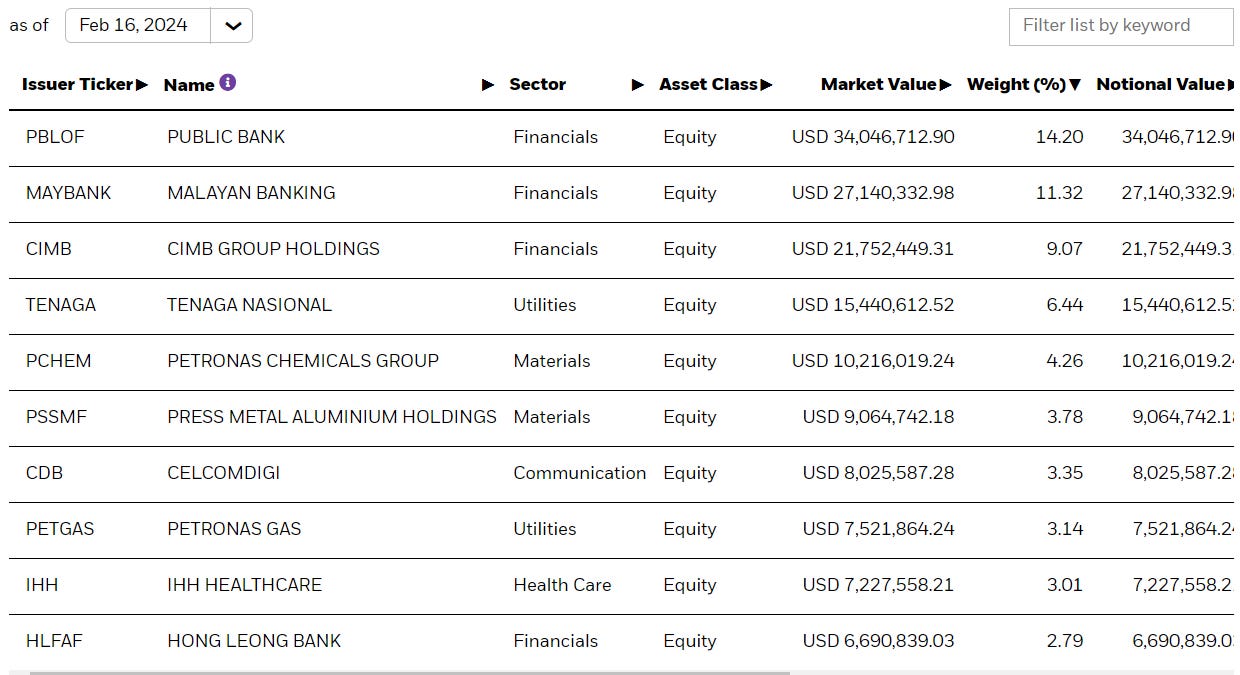

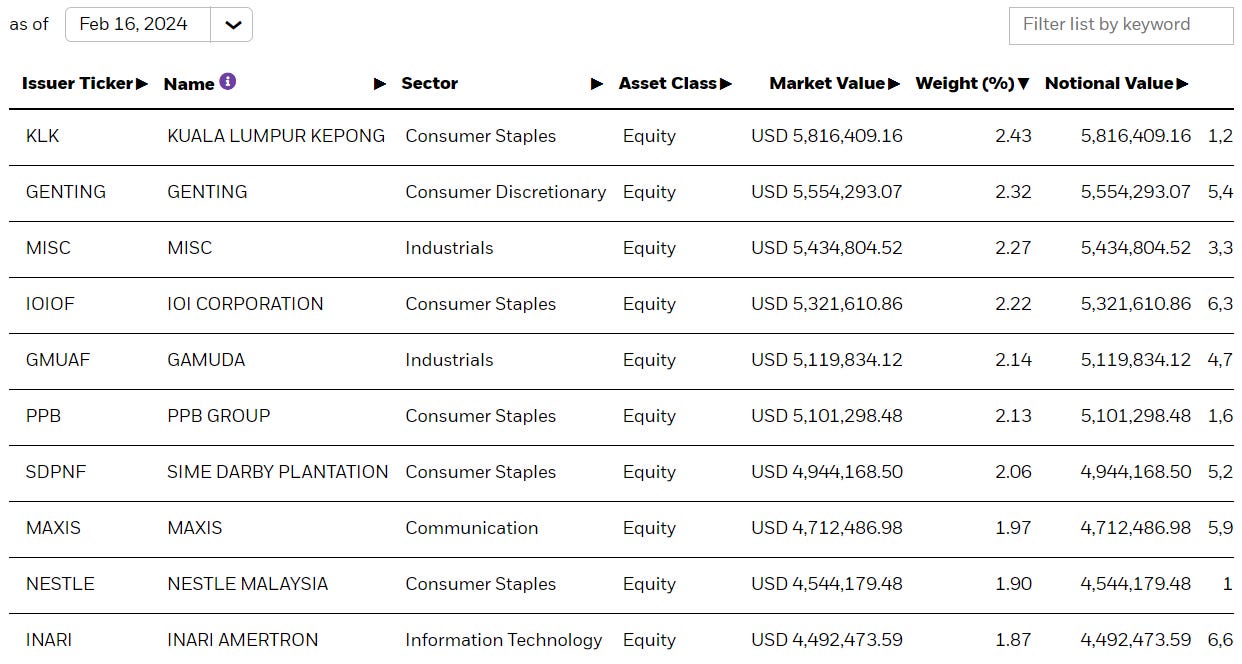

BlackRock’s MSCI Malaysia Equity Fund is capitalised at USD 239,653,062 (16th February 2024). The fund holds equity in hundreds of Malaysian corporations. The current exchange rate of RM 4.78 to the USD is allowing foreign equity funds like this by up Malaysian companies on the cheap. The BlackRock website shows the MSCI Malaysia equity fund holds equity in 37 blue chip public companies. The following screenshots show the breath and extent of the fund’s equity holdings.

Although, the above investments are made on behalf of clients, BlackRock fund managers have control of the assets, and would exercise any voting rights. One will also see upon investigation that many of the companies the BlackRock equity fund holds equity, are members of the WEF, in their own right. This includes CIMB Holdings, Tenaga Nasional, and Petronas.

BlackRock as partners and managers of Malaysian equity funds

In 2019, Affin Hwang Asset Management joined up with BlackRock to invest USED 3.93 billion into the BlackRock Global Funds (BGF) World Healthscience fund. KWSP or the Employment Provident Fund (EPF) invested USD 600 million into 3 funds managed by BlackRock, HarbourVest Partners LLC, and Partners Group AG. BlackRock also partnered with Malaysia’s Zurich Takaful to launch a Syariah compliant fund.

BlackRock are not necessarily passive investors

Other investments

BlackRock has invested USD 983 million into Malaysian government bonds to finance part of government borrowings. Several years ago, BlackRock sold the 62 story Vista Office Tower, 39 story Integra office building and a retail mall in the Intermark. BlackRock is an investor in real estate, but its not known how big their real estate portfolio is in Malaysia.

BlackRock’s most recent known Malaysian investment under the group’s Climate Finance Partnership (CFP) is a partnering with Ditrolic Energy Holdings Sdn Bhd in renewable energy projects.

BlackRock is displacing Malaysia’s own sovereign funds like Khazanah as the major investor in local equites in the country. It appears that BlackRock’s economic and investment philosophies are a major influence upon Malaysia’s economic policy directions, driving the economy today. Tengku Zafrul Tengku Abdul Aziz, as the minister for international trade and industry, and Nurul Izzah Anwar, as a senior economic advisor, as members of the WEF, are closely aligned with BlackRock philosophies.

The BlackRock Investment Institute has been seen active in Malaysia with recent consultation with the palm oil industry. It will be interesting to see how much more consulting the BlackRock Investment Institute does within Malaysia. With BlackRock terminology now very evident within Malaysia’s budget and five-year plan, one could see that BlackRock could very quickly become the premier consultant to the ministry of finance.

BlackRock’s influence in Malaysia is a force within the Malaysian economy, which will challenge the strength of Malaysia’s own sovereign fund equities investors. One can see there is now a strong level of collaboration between the two entities.

Here is another view of BlackRock

Subscribe Below:

"Most Malaysians probably don’t know what BlackRock is."

Sounds a tad patronising... You can quite reasonably say most Malaysians don't know anything (but think they do) too.

All the same, we have BlackRock practically owning Bolehland, but then the minds, hearts and souls of many a Bolehland politician, NGOS, media outfit, individual, are owned by many shady foreign entities, the NED, US State Department, various enterprises, the WEF, NGOs, and individuals, eg SOROS. And not to forget, the WHO...

May the Allamighty help us!

Oh! In addition, we have another lot of wonder cosplay artists dress themselves up as pirate copies of Arab pendatangs in our own country, Alhamdullilah!

Fcuking hell, with our seriously warped, corrupted, unoriginal, unimpressive and uninteresting monkeys, how and where can we grow our own home-grown, free-range wonders that can grow straight and tall on our soil, wtf?

OK, it's Garden Week again, go water our mental cabbages, bring along our prized bull manure, Alhamdullilah!

if BlackRock can help Malaysian economy, why not. Many graduates don't even have a job right now in Malaysia. So we don't need false alarm from anyone.

If I can get extra income to help my living, I don't care whatever ROCKS come to Malaysia. But I hate to see the rich and the powerful are only enriching their cronies as what happened by previous regime in Malaysia.