The Malaysian Ringgit has fallen 4.8 percent this year and we have not even reached the end of February. The Ringgit briefly touched 4.80 to the USD, the lowest since September 1998, when it reached 4.8850 to the USD, and a fixed exchange rate with the USD was set.

Bank Negara Malaysia Governor Abdul Rasheed Ghaffour said the falling Ringgit is not representative of the positive prospects of the Malaysian economy, and is the result of external factors. However, the Ringgit is the largest falling currency against the USD in the region, where all countries are facing the same external factors. Malaysia has an advantage over most other countries as RM28.7 billion of oil was exported in 2023.

Although aggregate exports rose 8.7 percent, year on year in January, Malaysia’s exports have been going down over the last 10 months. This is made worse with exporters not exchanging their proceeds back into Ringgit.

A sluggish China is being blamed for this. However, any recovery could be in jeopardy if recession continues throughout 2024, which some economists are now predicting. It’s becoming difficult to see where the forecast 4-5 percent growth in the economy will come from.

This is eroding Malaysia’s trade surplus, which was down to RM 10.12 billion in January. This is down substantially from a year ago. In addition, there was a capital outflow of RM 54.76 billion over the last twelve months.

The Madani government appears to be in panic mode. Malaysia cannot afford any interest rate cuts to spur domestic economic activity, due to further widening the interest rate differential between Malaysia and the United States. The government is looking at the prospects that business activity and consumption may slow down, as the world seems to be heading into a global recession. Any decrease in the overnight policy rate (OPR) would perceivably put further downward pressure on the Ringgit.

The weak Ringgit will further fuel inflation, especially foodstuffs, as Malaysia imports 60 of its food needs. Its unlikely the low Ringgit will spur increased exports either, as there is a long time lag in decision making about changing sources by importers.

Its easy to say political instability is the cause of the falling Ringgit. This is probably untrue.

Its also tempting to speculate that foreign equity investors are holding back to make future Malaysian equity purchases cheaper, leading to bargain basement opportunities. This also probably not true.

What is the possible reason the Ringgit is falling?

During the Covid pandemic the Malaysian government undertook record spending, creating record budget deficits, leading public debt to unprecedented levels above RM 1.5 trillion. After the pandemic, the government should have aimed to repay some of this debt, and espouse this is a major fiscal objective. Instead, Anwar Ibrahim’s 2024 budget once again announced record spending with a record deficit.

Increasing spending is increasing the deficit, and adding to public debt. With slower economic activity than predicted, tax revenue will be less than was estimated in the budget. Thus, the projected RM 82.6 billion deficit could be larger than was forecast.

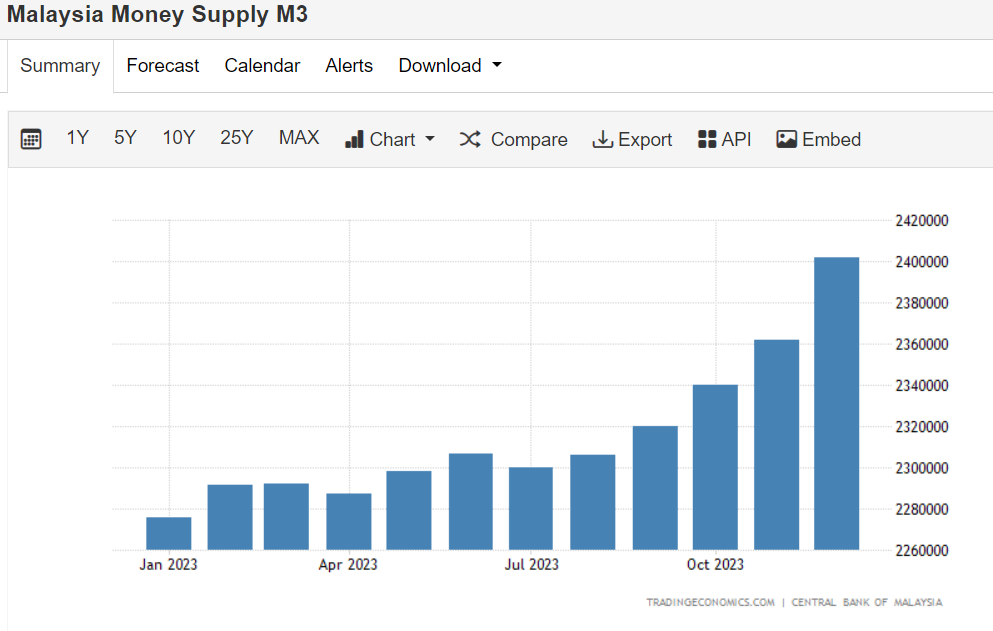

This deficit is being facilitated with an large growth in M3 money supply over the last quarter (3.7% Oct, 4.6% Nov, and 6.0% in Dec). Consequently, more Ringgit circulating in the economy, means a decrease in value. This is not only inflationary, but can influence the external value of the Ringgit to buyers in FX markets.

Out of control spending is the Achilles heel of the Ringgit. The Madani government needs a budget ‘razor gang’ to drastically cut government spending in the immediate future. This can signal to the BNM to stem the growth of the money supply accordingly.

This may result in some inflation and a domestic credit squeeze in the short-term. However, this should balance out if the Ringgit responds.

Reducing public debt will show the government is responsible. This should give investors more confidence in the Ringgit. The falling Ringgit could be a direct result of the government showing hesitancy in undertaking the reforms and necessary fiscal prudence that was expected. Espousing prudence should be enough to change the current ‘psychology’ of the Ringgit and the current trajectory.

Originally published in FMT 24th February 2024

Subscribe Below:

The Ringgit is falling because America 🇺🇸 wants Malaysia.

Why is it that when we have the supremacist race in our country, they can't even hold up the value of the ringgit, while those in Singapore can their currency?

We seem to have mainly a really unimpressive bunch in power throughout the decades who don't seem to be able to hold up their sarongs.

At least decades ago we had some big time speculators in the Three Amigos who very nearly bankrupted our country.

And the one-man band Soros could screw the Snake Pharaoh Mamakthir who helped him by getting our currency fcuked! While Mamakthir blamed Soros for his own flawed ways, the dirty old Mamak was quick to crawl to Soros in a hastily arranged meeting to prove he was useless at defending our currency.

The clueless Mullah Anwar may well follow Mamakthir's disastrous style as the ringgit nosedive to bite the dust. Anwar should set up his own "Council of Elders", find his own bunch of worthless geriatrics and let them advise and destroy Malaysia, Alhamdullilah!