Malaysia’s budget deficit most likely to exceed RM 110 billion this year

Mystery spending ‘holes’ and poor execution

Normally a supplementary budget would gain national attention because there would usually be some fundamental shifts in the economic assumptions behind the original budget, e.g., massive rise in interest rates, inflation, or major recession. Last April the finance minister II Amir Hamzah Azizan introduced the supplementary budget bill into the parliament.

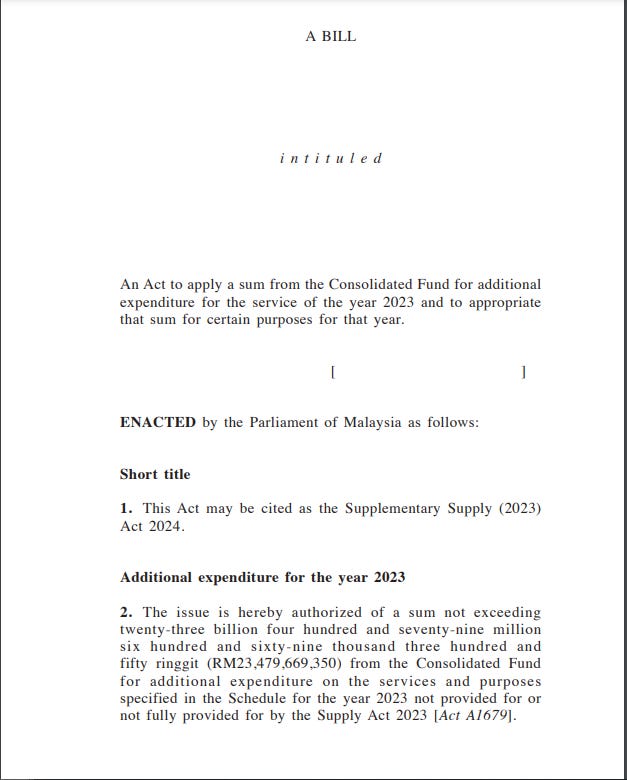

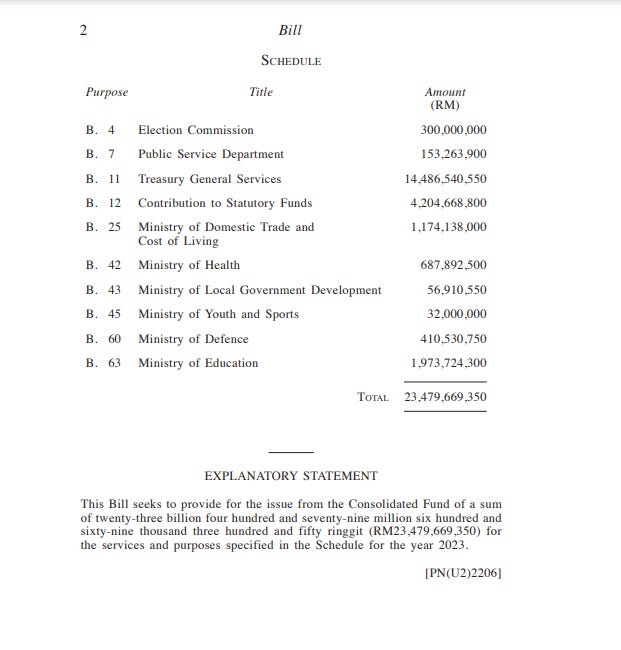

The second reading of the bill should have been accompanied by a long speech justifying the extra monies and why there should be a supplementary budget bill. This wasn’t the case. The bill requested the following;

The bill requested RM 23,479,669,350 from consolidated revenue to be allocated RM14,486,540,550 for the General Treasury Service, RM4,204,668,800 to the Statutory Fund, RM1,973,724,300 for the Ministry of Education (KPM), RM1,174,138,000 to the Ministry of Domestic Trade and Cost of Living, RM687,892,500 for the Ministry of Health (KKM), RM 410,530,750 to the Ministry of Defense, RM 300,000,000 to the Election Commission, RM153,263,900 to the Department of Public Services, RM 56,910,000 to the Ministry of Housing and Local Government, and RM32,000,000 to the Ministry of Youth and Sports (KBS).

This amount will increase the budget deficit from the original estimate of RM 86.5 billion in 2024 to nearly RM 110 billion.

This doesn’t appear to include the civil service pack increases which will add RM 10 billion to emoluments, which are already 31.5 percent of government operating costs. These salary increases would raise emoluments to around 41 percent of government operating expenditure.

The government has not announced how they are saving budget monies, except for the partial removal of diesel subsidies, expected to save RM 4 billion.

All this is contrary to what prime minister and finance minister Anwar Ibrahim said at the National Tax Conference 2024 in Kuala Lumpur on 30th July. Anwar was quoted as saying “In 2023, we reduced it to RM93 billion, and for 2024, we aim to lower it further to RM86 billion. This gradual reduction is crucial for continuing our development efforts,”

The third reading of the supplementary budget bill was passed in June contradicting him.

There appears to be very vague explanations about what a substantial part of these funds are actually for. Some RM 14 billion has not been itemized, which leads to questions about what its actually for. Something here is undisclosed, where the government wants things past without explanation.

The government is living far beyond its means here and actually increasing sovereign debt. In addition guarantees on behalf of GLCs like Petronas, Khazanah, PNB, and PTPTN loans liabilities are not included.

Finally, there have been issues involved to the dissemination of funds to identified parties that need them, such as SMEs. Almost RM 42 billion has been allocated to SMEs assistance, but SMEs are not receiving it. Either the disbursement apparatus has been poorly designed, or it has been done that way for other motivations, or these schemes are being sabotaged from sections within the civil service. From this distance its difficult to know the truth.

Subscribe Below:

Let us know how much of the money comes from duit haram. Then separate it from duit halal and spend duit haram on the non Muslims. For Muslims their financial support must come from zakat collections only. This is to make sure there is no moral contamination from touching money which has some lard on it. Jakim, mosques and Ulamas must make their stand clear. Absolutely no contamination by lard. If the Malays can agree to this, well and good. Otherwise they deserve to be called hypocrites.

Higher taxes on all fronts except for those items that are exported abroad. A further lowering of the Malaysian Ringgit will attract more foreign investment and discourage imports, especially luxury goods. The wealthy classes like the professionals and the non Malays who conceal their wealth in tax avoidance schemes will have to be penalized heavily and their properties confiscated. Hint hint. Mr. Ching Chong.