Number 2 2024: The silent invasion: The rise and rise of BlackRock in Malaysia

BlackRock is a major influence upon the Malaysian economy

Over the last decade US based equities firm BlackRock has become extremely influential within the Malaysian economy.

Most Malaysians probably don’t know what BlackRock is. BlackRock is the largest international investment corporation in the world. It manages global assets worth some USD 10 trillion. Founded in 1988, BlackRock had a dramatic ride to the top of the investment world, playing major investment roles in most national economies, including Malaysia.

Just note: BlackRock owns CNBC

BlackRock primarily invests funds for clients through numerous companies and funds. BlackRock also advises governments and has a close relationship with the US Federal Reserve. BlackRock play’s a major role in what is called an environmental, social, and corporate governance investment (ESG), and has become very active in the renewable energy and environmentally sustainable sectors.

Its also important to note that BlackRock is a major strategic partner with the World Economic Forum (WEF).

BlackRock’s influence within the Malaysian economy

Below is a brief summary of BlackRock’s investments within the Malaysian economy today.

Ownership of Malaysia’s corporations

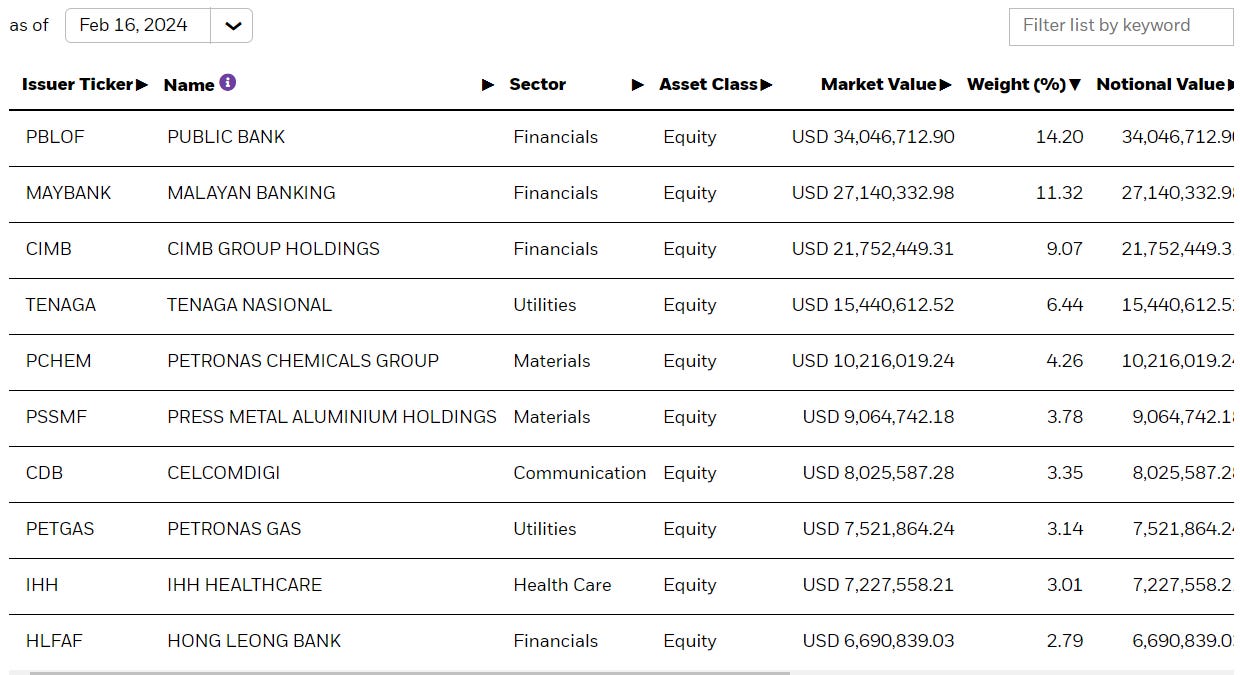

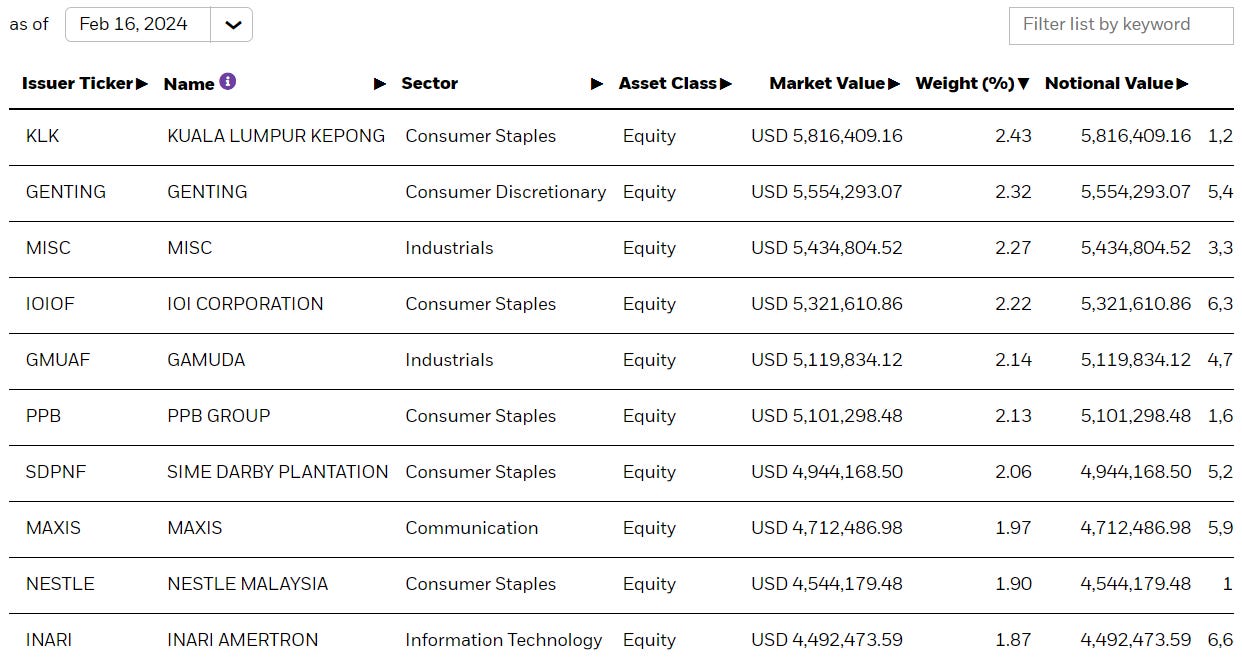

BlackRock’s MSCI Malaysia Equity Fund is capitalised at USD 239,653,062 (16th February 2024). The fund holds equity in hundreds of Malaysian corporations. The current exchange rate of RM 4.78 to the USD is allowing foreign equity funds like this by up Malaysian companies on the cheap. The BlackRock website shows the MSCI Malaysia equity fund holds equity in 37 blue chip public companies. The following screenshots show the breath and extent of the fund’s equity holdings.

Although, the above investments are made on behalf of clients, BlackRock fund managers have control of the assets, and would exercise any voting rights. One will also see upon investigation that many of the companies the BlackRock equity fund holds equity, are members of the WEF, in their own right. This includes CIMB Holdings, Tenaga Nasional, and Petronas.

BlackRock as partners and managers of Malaysian equity funds

In 2019, Affin Hwang Asset Management joined up with BlackRock to invest USED 3.93 billion into the BlackRock Global Funds (BGF) World Healthscience fund. KWSP or the Employment Provident Fund (EPF) invested USD 600 million into 3 funds managed by BlackRock, HarbourVest Partners LLC, and Partners Group AG. BlackRock also partnered with Malaysia’s Zurich Takaful to launch a Syariah compliant fund.

BlackRock are not necessarily passive investors

Other investments

BlackRock has invested USD 983 million into Malaysian government bonds to finance part of government borrowings. Several years ago, BlackRock sold the 62 story Vista Office Tower, 39 story Integra office building and a retail mall in the Intermark. BlackRock is an investor in real estate, but its not known how big their real estate portfolio is in Malaysia.

BlackRock’s most recent known Malaysian investment under the group’s Climate Finance Partnership (CFP) is a partnering with Ditrolic Energy Holdings Sdn Bhd in renewable energy projects.

BlackRock is displacing Malaysia’s own sovereign funds like Khazanah as the major investor in local equites in the country. It appears that BlackRock’s economic and investment philosophies are a major influence upon Malaysia’s economic policy directions, driving the economy today. Tengku Zafrul Tengku Abdul Aziz, as the minister for international trade and industry, and Nurul Izzah Anwar, as a senior economic advisor, as members of the WEF, are closely aligned with BlackRock philosophies.

The BlackRock Investment Institute has been seen active in Malaysia with recent consultation with the palm oil industry. It will be interesting to see how much more consulting the BlackRock Investment Institute does within Malaysia. With BlackRock terminology now very evident within Malaysia’s budget and five-year plan, one could see that BlackRock could very quickly become the premier consultant to the ministry of finance.

BlackRock’s influence in Malaysia is a force within the Malaysian economy, which will challenge the strength of Malaysia’s own sovereign fund equities investors. One can see there is now a strong level of collaboration between the two entities.

Here is another view of BlackRock

Subscribe Below:

Black rock is part and parcel of Regime Change, the Soros Foundation, the Open Societies and OTPOR. There are many more in that pack and they include the Bush and Cheney families, the Clintons and the a group of oil giants. Their membership clearly shows how fictituous and fraudulent the multi party system in the West is.

Black Rock is a capitalist behemoth of such proportions that it dwarfs some of the "seven sisters" (the seven largest oil corporations in the world). Black Rock owns many of them having swallowed their governments and replacing them with "Democratic governments". (another name for undemocratic despots)- e.g. Libya, Iraq and Qatar.

They first fund riots, massive propaganda villifying legitimate governments by claiming they are all corrupted, undemocratic and that the aspirations of the citizens of the target country are being oppressed, subjected to 'racism' and religious oppression. The feeble minded intellectually vacant (Malaysia's "educated" elite) fell for it.

When the target government weakens through defections and growing unrest, by the rioting and propaganda. Regime Change deify a single entity, political party or indivudual (Anwar,Mohammad Yunus) and create a hero out of him.

They white ant the courts by bribing heavily the legal fraternity, churches and other religious groups (Like "Muslims for democracy") and buy celebrities to further avance their causes. They create awards like "the woman of courage" and "best investigative journalist" two of the many previously unheard of and uncredentialed awards given to those compromised individuals they have recruited locally for the purpose.

Sounds familiar? Well well. Lets look at Malaysia as an example. Ambiga and Tommy Thomas deified as "brilliant lawyers" and "constitutional experts". 2 under performers who could not even read from a script on topics they are supposed to be experts in.

Eliabeth Wong and Teresa KoK, Waytha Murthi and Mariah China Abdullah, the latter, a woman who falsely claimed to have married a member of Yaser Arafat' force 17. Really? There was the entire board of the Malaysian Bar. Late High Cout justice NH Chan, Vohra, Sri Ram Gopal, Tunku Maimun Tuan Mat and even two former Agong of Malaysia.

The goings on by Bersih and the legal fraternity gave credence to the investing public that Malaysia was corrupted to the core.

When such sentiment permeats the investing public aided by suspect organizations like Transparency Internationl (a German, French, Australian and Australian government initiate with the gall to call themselvs an NGO), the ringgit falls and the Western edited tools of sovereign and investment, the ratings agencies engineer a fall in the credit ratings and their currency in the target to unacceptable levels.

Creditors from International Banks and the multi lateral lenders feign nervousness and call in their loans or force their clients to re negotiated their debts and restructure the ownership of their public assets from electricity, energe companies an transport hubs..

This is where Black Rock comes in. It posses as a white knight and buys the sovereign debt of countries like Malaysia during this period and in the process take over its infrastructure assets for a song. It owns the country through this process by deliberately then keeping the local currency artificially low.

It is the reason India and China are at the receiving end of the Regime Change propaganda of corruption and racism. It is an attempt both giant nations have thus far successfully resisted.

It seems I read something about BlackRock managing the international airport, as well. It causes concern.