Personal care with its artisan beginnings is one of the oldest FMCG industries in existence. The craft began more than 2,000 years ago with skilled artisans producing candles, soaps, and fragrances, very highly valued products by those who could afford them at the time. These collected crafts emerged into a mass consumer industry by the middle of the 20th century. Over the last 25 years the industry has again undergone some massive structural changes. Today the personal care industry could be considered highly concentrated throughout each stage of the supply chain. Yet paradoxically, the industry is now more fragmented and layered than ever before, if one knows where to look. This leads to the question of “what is needed to make a personal care company successful in today’s environment?”

Personal care items range from products that are important to a person’s hygiene, to those that are used purely to enhance self image and develop a persona for others to see. Consequently people tend to use personal care products for reasons other than the primary functions, i.e., hygiene or colour, etc. Personal care products have something to do with acceptance, approval, image, and hope. When an underdeveloped economy progresses towards development, one of the first consumer sectors to emerge is the personal care industry. This shows the importance of these products, although many are considered luxury items. In addition the industry is also one of the heaviest users of media advertising.

What constitutes personal care products has become very blurred in recent times. Personal care products take on the characteristics of cosmetics, fragrance, aromatherapy products, pharmaceuticals, and even insecticides. A very rough breakdown of personal care categories are listed in table 1.

Table 1. A breakdown of personal care product categories.

1. Skin Care products

1.1 Bath products

1.2 Skin cleansers

1.3 Skin care products

1.4 Eye care products

1.5 Lip care products

1.6 Nail care products

1.7 Feminine hygiene products

1.8 Foot care products

2. Products with special efficacy

2.1 Sunscreen preparations

2.2 Skin tanning preparations

2.3 Skin beaches

2.4 Insect repellents

2.5 Insect bite lotions

2.6 Deodorants

2.7 Antiperspirants

2.8 Acne care products

2.9 Depilatories

2.10 Shaving cream

2.11 Perfumes

3. Oral care Products

3.1 Oral hygiene products

3.2 Denture cleaners

3.3 Denture adhesives

4. Hair care products

4.1 Shampoo

4.2 Hair care products

4.3 Hair setting products

4.4 Hair care products

4.5 Hair setting products

4.6 Hair waving products

4.7 Temporary and permanent hair colourants

The concept of success

When looking at what makes a successful company, one has to first define what success means. To simply say success is about market-share, sales, market domination, brand recall, profit, and ROI would be too simplistic and fail to recognize that companies and enterprises are as much about their founders, as they are about the products they make, sell, market, and distribute. Success is related to the ambitions, aspirations, and visions of the founder. The founder may just love being part of the industry and delight in producing batches of the finest hand-made soap, or the most beautiful natural perfume. His or her love may be serving a very important customer as a contract manufacturer, and lifestyle is the key to the person’s own image of success. Too many “MBA’s” dismiss the importance of craft and smallness, and are prepared to write off these manufacturers as irrelevant to the market. Nostalgically these artisans are the remains of our spirit and for that reason alone those keeping the craft going are highly successful individuals with ‘golden enterprises.”

Thus the scale of the business is important when defining what success is. As mentioned above for many micro-SMEs it’s about the craft. Income enables the enterprise to continue providing the founder with the ability to practice his or her craft. This can be seen with many small hobbyists, those eco-tourism farms producing specialized soaps and lotions, and natural perfumers all around the world. Their success is being able to do what they love.

Many family based businesses probably started off as a craft based organization and grew to something much larger over the last couple of generations. Unfortunately, family based businesses are a dying breed and have to compete against conglomatized multinationals. To a great degree, family based businesses continued success is about survival and competing against much stronger adversaries.

Then finally there are the multinationals themselves, primarily conglomerates of brands that think in-terms of market dominance, high market-shares, high volumes, distribution matrixes, profit and return on investment. Their success criteria is easily measurable with the standard business performance measurements of the day, with sustainability, ethical compliances, and developing low carbon footprints for their products and firm as added criteria.

Success is actually a very relative concept. It really has more to do with the personal ambitions of a founder or the corporate objectives of a large firm. The rest of this article will look at the areas where a firm must develop competencies and capabilities to be successful according to whatever vision founders and managers may have.

Some of the characteristics of success

The market modus operandi the founder chooses for the firm can be seen through the products placed into the market. This reflects both the opportunities the founder/managers perceive and the identity that the firm wishes to develop and project. This is the living essence or “soul” of the company, reflecting the ideas, values and mission of the firm. It starts with the branding, product and sales narrative, right down to the types of packaging, raw materials and service policies that support the firm’s operations. The essence or soul of the company can be seen in ‘the way people within the firm do things’.

Firms have a choice of three basic market types to enter and participate in.

The firm may enter the first level focusing on contract manufacture for other marketing and retailing companies. Within this domain successful contract manufacturers are technically savvy, fully understand what their customers require, and are able to produce products of high quality, very effectively. Success here comes from being able to foresee the needs of others with the competency to fulfill them. To a customer, a supplier that efficiently and effectively services their needs can be considered a source of competitive advantage. Reputation as such will bring many potential customers to your doorstep.

At the second level a firm may manufacture their own branded products for specified markets. This is where the majority of personal care companies exist, within some layer of the mass market in either, discount, supermarket, pharmacy, salon, or branded store markets. Each market layer will have a particular set of idiosyncrasies or culture which must be adopted and adhered to in order to be successful. At this second level firms take a functionalist approach working back from what managers believe consumers want. Product attributes are focused toward providing efficacy with a sense of value for money. This is a very competitive area because usually most companies make the same or similar conclusions about what they believe consumers need.

At the third level, firms and the products exist for some basic reason that becomes the whole persona about what they do. The products exist on some deep passion and belief. The products represent the beliefs and values the founders want to share with their customers. This is very different from the second level where managers try to read what consumers want, a passive reactive approach, rather than proactive creativity required at this level in actually creating new market space.

In this third case products are innovatively constructed with a theme; be it sustainability, ethics, Halal, ethnic, natural, and so on. It is in this area where the rewards are very high for young companies with great ideas, like we have seen with concepts espoused by likes of Aveda, The Body Shop, and Thursday Plantation, among many others for example over the years. One must remember that this is a very high risk strategy. Very few succeed. For every successful company there are hundreds of failures and if you are not totally committed to your cause, consumers will eventually find out and punish you severely.

**********************************************************************************

Capabilities and competencies

A firm must have the capabilities to be able to exercise the necessary market competencies to be successful in the marketplace.

First of all, a firm must be able to enter and operate within the particular market channels it has selected. This requires developing good working relationships with chain store buyers and wholesalers at salon level. In today’s highly concentrated store ownership a good relationship with buyers can offset some of the disadvantages of being a small company within a sea of multinationals. There is also the option of using a sales broker with ‘these relationships for hire’.

What is extremely important is that trading terms are negotiated and utilized correctly. Trading terms has a great bearing on the range of products carried by the retail chains. Within many chains, central listing and addition to the shelf planogram may not be enough. Sales staff may be required to make personal visits to familiarize store staff with the new products and in some cases assist in merchandising, particularly through independent stores that are members of branded wholesalers.

Remember the old sales days are long gone. Retail chains will not list and carry lines that compete on price with established brands because it erodes gross profit margins. Retail chains will only list products that have an appealing theme to consumers and will maintain and increase gross profit on the shelf.

Product themes must be supported. They should be supported at two levels, if not three.

This first is what is called ‘below the line’ promotion which includes, periodic case deals, discounts, quantity buys, display and shelf promotions at store level. These will usually be negotiated during product listing and again each year during product reviews with the chain buyers. As much as 20-25% of gross sales need to be allocated to in-store activity. This should be planned and negotiated well or a lot of funds coming straight off the margin of the product will be very quickly wasted.

The second level is what is called ‘above the line’ or media advertising. This will include spending on radio and television, and cinema time, and magazine, and newspaper space. Very rarely would a retail chain list a product without some ‘above the line’ media support. Multinationals would spend between 10-25% of their budgets on media.

Launching a new and maintaining an existing product through media is expensive as it requires cash funds to do so, unlike ‘below the line’ promotion. One of the challenges for SMEs with very limited funds is being able to create and develop an effective media campaign. Here great creativity is required to find as much free media as possible through radio and TV interview, newspaper and magazine reviews, and of course online blogs and other social media. Don’t forget a product advisory website as well. Don’t make the mistake to skimp across this area lightly, particularly if you have a new brand to support. The correct promotion brings very positive results which you would not readily be able to achieve sales wise through other methods.

Don’t forget social media. Social media is not as yet a primarily means of promotion but very supportive in relaying interviews and reviews that you have got from the mainstream media. Also remember unsatisfied customers through social media have direct access to the rest of your customers like never before. Handle any customer complaints promptly and satisfactorily and maybe an initial customer complaint can turn into something beneficial.

Make and buy – some considerations

The production costs for mass produced high volume products are at the point where it is difficult not to make the decision to source from overseas. Look at the costs of implementing GMP and meeting EPA regulations and sourcing your product offshore looks even more attractive.

Finding a supplier that you can work closely with and develop some mutual loyalty is a challenge. Australia and New Zealand are small markets compared to North America and Europe. Where you may require 1-2 20ft containers per month for a product, US personal care marketing companies may buy as much as 20 times that quantity. So it’s not hard to understand you may not get the attention in places like China you feel you deserve. So you have to work hard on getting a contract manufacturer’s interest and build up that relationship. As Sun Tzu said an army s only as good as the supply chain it uses, so an excellent supply with a close working relationship will be a great advantage. This in the long run will allow you to focus on sales and marketing, and the big bonus here is that through the savings you make on offshore manufacture, more can be spent on brand development through advertising.

Some low volume, and/or specialized products are best kept in-house, especially if there are some unique characteristics to the product. In these cases you need to invest on the engineering side of the product manufacturing process and lower the labour and handling costs as much as possible. You don’t need me to tell you what the hourly factory labour rates are.

Create barriers to entry for potential competitors

During my career in the household and personal care industries, for any new product I would try to create a barrier to entry for any potential competitor. Having sole access to any piece of market-space enables one to create a value monopoly, allowing above average profits for a period of time the barrier to entry is maintained. This can be achieved a number of ways. As discussed in the next section, arranging your IP strategy correctly is a powerful barrier to entry, as any configuration is unique, especially if it is difficult to copy. So this may mean a patent on a formulation, process, or form of packaging, the use of raw materials others don’t have access to, or especially close relationships throughout the value chain. Developing barriers to entry may involve building your own plant and machinery for specialized products, or producing your own raw materials such as basic soaps, preservatives, enzymes, and perfumes, etc. Being able to downscale expensive production processes for a fraction of the cost that other companies invest is one of the best ways of creating a powerful advantage other competitors.

Any barrier to entry won’t last forever, so one must continue to develop new barriers and create new products with new barriers to entry. Don’t forget a brand is one of the best barriers to entry. Barriers to entry are powerful sources of competitive advantage that are not fully utilized in the industry today by smaller firms. This is a very important aspect of success and may enable a small company to compete effectively with a multinational.

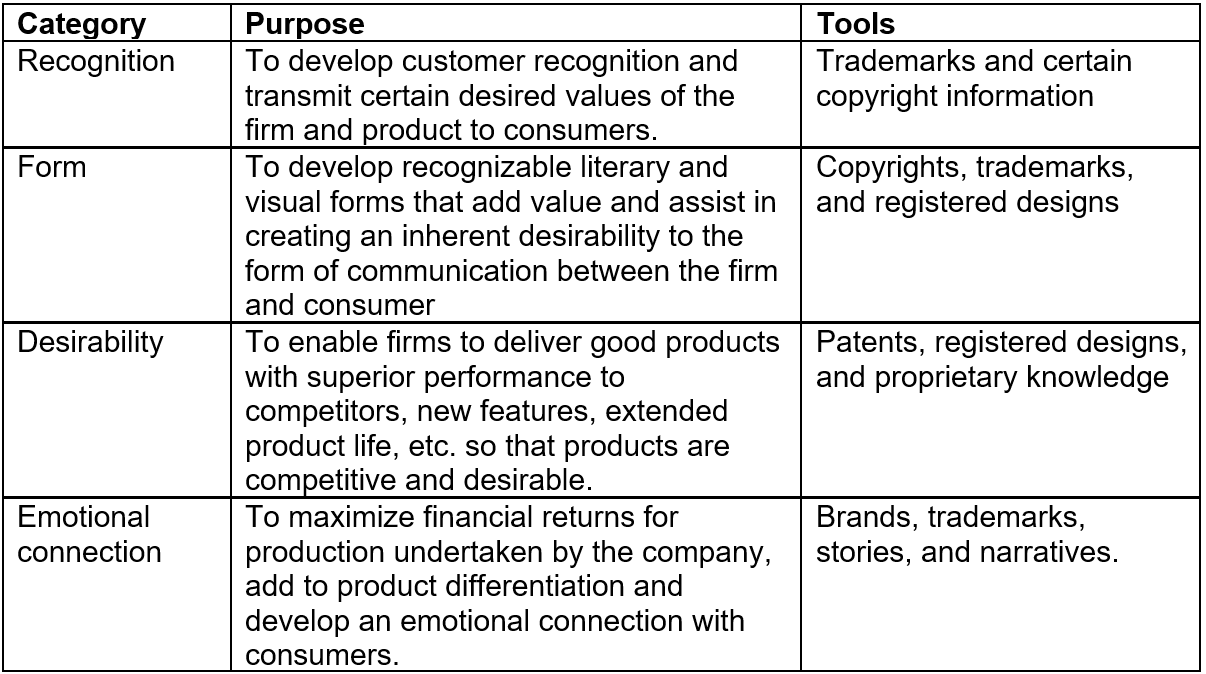

Recognize what is your IP and use it well

All businesses involve intellectual property. Intellectual property is much wider than patents, trademarks, research and development, and brands; it’s the way you do things, expressed as your total strategy out in the market-place. Understanding this, coordinating your IP and using it to your advantage, is the best way in creating a barrier to entry as we discussed above. Developing intellectual property in this holistic manner is the key to creating the value monopoly for your product and firm that will reap large financial returns.

Intellectual property is a product of competencies. IP can be considered a box of tools that can be coordinated in a particular way to fulfill marketing and protection objectives. If done correctly this will be of immense benefit to the firm and create a strong source of competitive advantage. The array of tools that can be used are listed in table 2.

Table 2. Intellectual property tools and there assistance in firm strategy

Stay close to the knitting

Peters and Waterman in their classic book ‘In Search of Excellence’ strongly advised that the most successful corporations in the United States during the 1980s were those that ‘stick closely to the knit’. Too many companies that experience some success diversify outside their domains of success and end up with all sorts of problems. For this reason S.C. Johnsons sold off its Agree Shampoo range while it was No. 1 to focus back on its household product range. It is very rare to see a company that is both dominant in personal care and say household products. Successful companies build upon their existing based, rather than build new bases.

It’s about the founder just as much as anything else

There is an extremely close correlation between the founder and a successful enterprise. Without a founder there will be no enterprise and the performance of the founder is actually what creates the enterprise. So no surprises, the qualities of the founder are paramount to success. This isn’t about personality, or particular traits, it’s about a way of thinking.

The most important element is vision. Without vision or a roadmap about what the founder wants to create for the future, it can’t be created. Along with this vision must come a high passion and motivation, almost to the extent of being compulsive. Secondly any founder must have a sensitivity and alertness to the industry. He or she must be able to see things that others are unable to see to pick up unique opportunities. Generally because of this many successful new enterprises within the personal care industry are started by those with prior experience within the industry.

Successful founders possess a strategic outlook that enables them to see where they are going and the consequences of any action they take. For example, they will know how their competitors will react and the financial, production, and inventory consequences of any one action. It is this way of thinking that will guide them and this is accompanied by a strong propensity for action. Founders who think too much about the actions they take may be hesitant and fail to take any necessary steps to solve problems when they arise, or miss immediate opportunities that have large long term benefits (the down side may be reckless decision making).

A good strategic outlook and propensity to act must be accompanied by the relevant skills and abilities. These may include technical skills in product development, interpersonal skills in sales, and the ability to work with others. A person cannot do everything by themselves so must be able to gather and work with a team. The founder must have the personal creativity necessary to utilize all these skills in the pursuit of his or her objectives and solving of arising problems and challenges on a daily basis.

Finally the founder must have the courage and determination to follow their visions. So many people hold visions about what could be but never act to fulfill them. The absence of any of the above characteristics would severely hinder any chances of success.

Conclusion – and in the end it’s up to you

Any business is complex and there are indeed so many factors that contribute to any success. Likewise there are so many factors and miscalculations that can lead to failure. These could be basic business mistakes about holding excessive inventory or strategic issues like selecting market categories that don’t have enough potential customers to make an enterprise viable – a trap many SMEs fall into.

A successful personal care company is about products, channels, networks, image, narrative, promotion, competitors, and intrinsically understanding the nature of the consumer you strive to serve. One must think in a holistic way, but also be focused upon all the detail and create and develop the right products, develop the right image and channels, and answer four important questions satisfactorily for maximum success;

1. What is the central theme of your product?

2. Are there enough customers?

3. What channels do you need to go through to reach your potential customer? And

4. How much competition will you face?

The human race has sent men to the moon, cured many diseases, mapped the human genome and descended to the deepest depths of the world’s oceans, but nobody can be really too sure about the reasons why one business is successful and another business is a complete failure. What really makes a shampoo, fragrance, or spa a success? People who say they know are really guessing. We can only really tell what the next big thing is when it becomes the next big thing.

However we know that the reason for a business success is based on very tight, but not necessarily apparent factors, of which the successful entrepreneur may not even understand. Who can tell exactly why Lady Gaga is a success? You can give me a number of reasons but can’t tell me which ones are most important. If you could predict the future hits with any certainty – no doubt your already a multi-billionaire and not reading this.

Business success is about the future and there is no way to predict the future accurately. So any new business is developed along the lines of trying something to see if it works, and then keep doing that thing if it actually worked. Success doesn’t come from beautiful business plans, it comes from experimenting until – BINGO!!! You’ve got it. Then you have your own magic formula that works only for you and your situation.

There is a unique and hidden success formula waiting for you to find in your business. You may stumble upon it very quickly or never find it at all. There are plenty of business books out there with the 10 rules, habits, or points that claim to lead to success. The factors mentioned may exist but not necessarily be the true reasons behind your success. Having a lucky charm may have just as much influence over the matter.

Originally published in The Science of Beauty August 2015

Click on subscribe so articles can be directly emailed to your inbox: